Most personal finance plans fail because they are based on self discipline.

At least, that is the viewpoint of the authors of Your Money or Your Life. And wow!—that is a very different viewpoint than most personal finance writers! Many people feel it’s a viewpoint that is absolutely refreshing.

(Because sometimes it feels like the articles on saving money are trying to make us feel bad… for occasionally enjoying an avocado!)

This book, on the other hand, starts from the inside out. It says that if we want to change our outer financial situation, then we must first change our deepest beliefs about money. If we do that, then it will feel effortless to save money, eliminate debt, and become financially free.

In this book summary, you will:

- Learn what money really is. You may be surprised to find out most of us have no idea.

- Understand who you really are. So you can escape society’s pressure towards empty consumption.

- Bring more consciousness to your life. Specifically, to how money is flowing in your life.

About the authors

Joe Dominguez reached financial independence and retired at the young age of 31. He worked as a financial analyst and writer on Wall Street, but only made an average person’s income. He was able to retire so early because he had an effective financial plan, a plan he later shared with the world in his book Your Money or Your Life (official website).

Vicki Robin co-authored this book with Joe, and she has written other books about sustainable living.

🗝️ 1. Value Savings as the Path to Freedom: Recognize how escaping the cycle of endless debt opens the door to financial freedom.

Most of our parents and grandparents entered debt with the goal of paying it off quickly and then staying out of debt. They saved up beforehand to pay for large expenses rather than putting them on the credit card to worry about later.

Very recently, everything has changed:

- In 2005, for the first time the rate of savings in the US fell below 0%.

- Today many people are eternally in debt, and feel it’s okay because that’s what everyone else is doing.

- An example: in my country of Canada, more than 50% of new car buyers are signing loans not for 3 or 5 years, but 7 years! Not long ago, paying off a car for that long was unheard of.

We have been taught that “debt is freedom” because it lets us buy what we want now. But the reality is the opposite: debt equals servitude. With debt, we become trapped in jobs we hate and scared because even a small tragedy can turn our life upside down.

So, what’s the answer?

Savings.

Savings equal freedom.

- 6 months in emergency savings should be your #1 short-term goal, according to the authors of Your Money or Your Life. That means you have enough money set aside to pay for 6 months of expenses if you suddenly couldn’t work. With this cushion of safety, you’ll enjoy greater peace of mind that you have the support you need to overcome life’s inevitable storms.

- Full financial independence should be your #1 long-term goal. That means making enough passive income from your savings so you don’t need to work anymore. By the end of this summary, I hope that you’ll see how this is possible for you.

Another book that strongly emphasizes “escaping society’s matrix” is The 4-Hour Workweek by Tim Ferriss. His approach is very different, focusing on building an online business that provides passive income to fund our ideal lifestyle.

The first step, according to Tim Ferriss, is for us to ask more questions about all the rules and assumptions of society that we follow. For example: why does almost everyone work 40 hours per week, no matter how much they make or what work they do? It doesn’t really make sense for every single job to require the same amount of time, does it?

Once we see that many social norms are baseless, then we will feel freedom and confidence to walk our own unique path. As Ferriss writes, “If you are insecure, guess what? The rest of the world is, too. Do not overestimate the competition and underestimate yourself. You are better than you think.“

We’ve been taught that debt equals freedom, but in reality debt makes us trapped and scared. Instead, savings equal freedom. Our #1 goal in the short term must be 6 months of emergency savings, and in the long term enough passive income to live without needing to work.

🛑 2. Embrace ‘Enough’ Over ‘More’: Learn to identify the point of enough in consumption, avoiding the trap of perpetual wanting.

In their financial seminars, Joe and Vicki often asked the audience how much more money they need. And guess what? Almost everyone said they needed 50% to 100% more! That seems to show that no matter how much money we make now, we always need more.

We all know that money can’t buy happiness, but what do our actions say? With our actions, thought and beliefs, almost all of us crave more. As Robert Cialdini, a professor of psychology wrote “Our best evidence of what people truly feel and believe comes less from their words than from their deeds.”

Why won’t getting more make us happier? There are two major reasons:

- Hedonic Adaptation. That’s just the fancy psychological words for “we quickly get used to what we have.” It’s why people who drive past in a new luxury car don’t appear any happier than those driving by in an old beat-up car. We buy something new, feel good for a little while, but the feeling fades. Then society comes and tells us we need just one more thing, then later one more thing, and later one more thing, which leads to…

- Clutter. Eventually we reach a point where each new thing that we buy actually makes us less happy. When we have too many things, that leads to clutter. We have objects that take up our space, resources, and attention, and only make us feel more stressed and overwhelmed.

This reminds me of a different quote that says “you can never get enough of what you don’t really want.” (Which I believe comes from self help author Wayne Dyer.) It’s impossible to fill emotional or spiritual needs with material consumption, although that doesn’t stop many people from trying.

We all say money doesn’t bring happiness, but our actions tell a different story. Many of us fall into habits of spending our money on things that not only don’t bring us joy, but actually add unhappiness to our lives because of the added clutter.

⏳ 3. Treat Money as Life Energy: Understand that money represents your precious, irreplaceable life energy – and deserves careful management.

To most of us, money feels vague and abstract. It’s paper, it’s coins, it’s just numbers on a computer screen. What is it really?

Let’s end this confusion now. Money is really our life energy. This may be the most important idea in the whole book:

Money is life energy! That means when you buy something, you’re not trading paper or coins or digital bits for that thing. What you’re really trading is some of your life energy.

For example, if you made $20/hour and bought jeans that cost $40, then you just traded 2 hours of your life energy for those jeans. Seeing money as life energy bring clarity to our spending. Try it yourself. Next time you buy something, convert the price into the hours you had to work for that money. You may never look at buying something the same way again!

This reminds me of what Henry David Thoreau, a famous classic writer, once said: “The price of anything is the amount of life you exchange for it.”

Our life energy is finite—that means we only have a limited amount of it. So doesn’t it make sense to treasure our life energy, to treat it with care and consciousness? (I can hear you thinking “YES!”) Well, this is the real meaning of the word “frugality.”

Being frugal is not about being cheap, but about getting maximum fulfillment from our expenditures of life energy. For example, buying an expensive pair of shoes can actually be frugal, if they are high-quality and will last a long time and you’ll really enjoy them. In fact, it could be far more wasteful to buy 10 cheap pairs of shoes that you don’t really like that end up sitting in the closet.

So, to be more frugal, start from the inside out:

- Understand the importance of your personal values. Your values are simply what you find important. When we’ve lost touch with our values, then we resort to seeking pleasure and status through consumption of goods.

- Ask yourself questions to discover your values. Some of my favourite questions for this purpose include… Who do you admire and why? What would you do all day long if money were no worry?

Money is not just paper of digital bits, money is your life energy, which is limited and irreplaceable! Being frugal means taking care of our life energy, by spending it wisely to get maximum fulfillment. The first step is getting in touch with what we find truly important.

💼 4. Calculate Your True Wage: Consider the hidden costs of your job to determine its actual financial benefit.

So far, we’ve laid the foundation of what kinds of beliefs you need to carry about money. In the rest of the book summary, we’ll discuss the author’s practical ideas for changing your financial life.

So buckle your seat belt, because we’re just getting started!

The first question you need to answer is: What are you really selling one hour of your life energy for? Most of us think this answer is easy, but that number you see on your paycheck can be very misleading.

The book includes an exercise to calculate your “real hourly wage.” Basically, you start with your monthly income, then you add how many additional hours your job requires outside work, then you subtract how much money your job costs.

Many of us don’t consider all the extra expense, in time or money, that our job costs us. That includes transportation, maybe a second car, fuel, maintenance, insurance, work clothing, extra grooming, extra takeout meals… not to mention all the money and time we need to unwind after work or pay others to do work we cannot like daycare or home upgrades.

When all your job’s additional costs are calculated, you’ll probably see that you’re making much less than you thought! That may sound bad at first, but it can often be good news. Your current job is not worth as much as you thought.

Many readers of this book did the exercise and realized they could continue making the same amount of money at a different job that was closer to home, easier to do, and more flexible. Their high-pressure jobs had many invisible costs they had never considered. When they quit, they were much happier!

Probably the most popular personal finance book ever is Rich Dad Poor Dad by Robert Kiyosaki. It shares the story of Kiyosaki learning from “Rich Dad,” a man that was really his friend’s father and a very successful entrepreneur. The biggest lesson he learned was “The poor and the middle class work for money. The rich have money work for them.”

In other words, poor and middle class people make their income from working. But rich people buy or create assets that generate income, whether or not they are working. The assets could include stocks, bonds, real estate… entrepreneurs even create new assets like a business, website, or social media presence that generates income.

What are you trading each hour of life energy for? Start with the number on your paycheck, then add additional hours you spend because of your job, then add additional expenses because of your job. Then you’ll know how your “real hourly wage.”

🙌 5. Let Go of Financial Regrets: Reflect on past financial decisions with “no shame, no blame” – embracing a mindset of learning and growth

The next thing this book recommends is gaining clarity on your financial past. Here are two steps for how to do this:

- Add up your total lifetime earnings. How much money has passed through your life up to now? You can find this number by looking at past tax returns or contacting the right government office.

- Find your current net worth. How much are all your possessions and savings worth altogether right now? This is ‘what you’ve got to show’ for all those years of working and trading your life energy.

This exercise is only about understanding where you’re coming from, so you can point yourself towards a better direction from now on.

If feelings of guilt come up, the authors recommend you repeat a mantra to yourself: “No shame, no blame.”

The authors clearly believe that bad feelings are not useful for changing our behavior. Instead, they believe that our behaviors will change automatically with increased self awareness. And you get that self awareness by doing these exercises, so you become aware of exactly how the energy of money has been flowing through your life up until now.

I think this approach is quite unique for a personal finance book. I am reminded of a quote from the great psychologist Carl Rogers who said, “When I accept myself just as I am, then I can change.” I don’t want to get off track here, but I deeply believe that honesty about our flaws leads to self-correction and improvement, while guilt and shame tends to cause self-delusion and denial.

Seeing our financial past with clarity is the best way for us to begin getting on the right track. We can do this by calculating our lifetime earnings and then our current net worth. If bad feelings come up, remember ‘No shame, no blame.’

🔍 6. Raise Your Financial Awareness: Keep a close watch on how you spend your life energy (money), promotes mindful spending

At the core of this book there is a system of keeping track of where your life energy (aka money) is going. The authors believe that if we write down all our spending and reflect on it regularly, then our behaviors will naturally shift. Over time, we will spend less on things that don’t bring us much fulfillment and more on what gives us joy.

This financial system of Your Money or Your Life has 3 parts. Here’s a very brief summary:

- Keep a daily money journal. Write down every single purchase, either in a notepad or in a mobile app. This simple act will increase your self awareness about where your money is going.

- Add up spending monthly. At the end of each month, go through your expenses. Divide them into major categories, then find how much you spend on each category.

Convert the dollars into the amount of life energy you spent. Then ask yourself, “Was it worth it?” Put a plus or minus beside the category if you feel that you should spend more or less according to your values, or a zero if you feel there should be no change. - Create a yearly wall chart. This chart will only have two lines, one for monthly income and the other for expenses. Each month update this chart to see whether these numbers have gone up or down. Put it on a wall somewhere you will often see it.

The authors say that after 3 months, most people who follow this system will find their expenses going down automatically, simply from the increased awareness of where their money is going.

Personally, I’ve used systems like this in the past for productivity. Being self-employed, I don’t have a boss that keeps me accountable, so I have to keep track of my own work to make sure that I’m not sliding into habits that are unproductive. That means I’ve often kept track of my work hours on charts and graphs that I hung on a wall where I would always see them.

The influential business writer Peter Drucker said “What gets measured, gets managed.” I’ve found that simply measuring the number of productive hours I worked was a great motivator to increase my productivity. No shame needed, but only greater self awareness.

Writing down where money is flowing in your life, so that your awareness increases, which will slowly but automatically improve your future behavior. Write down all your daily purchases and analyze them monthly to find out where your spending does not align with your values. Finally, make a monthly wall chart that shows how your income and expenses change over time.

🚀 7. Use Investing to Achieve Freedom: Transform your savings into workers for your financial independence

Over time, on your wall chart, you will begin to see a growing gap between the two lines, between your decreasing expenses and your steady income. This gap is your savings. Now, those savings can be put to work for you, earning you additional income through investing.

The authors say you can later add a third line to your wall chart which is “income from investments.” At first this income will probably be very small—$20 or $50 per month—but it will grow over time.

Now here’s the really exciting part. When that line for “income from investments” grows higher than your line for expenses, then… you are free! That’s right! Free like a bird! In the book, they call it “the crossover point.” Basically, that is the day you are making enough money passively from your savings that you no longer need to work.

But let’s not get ahead of ourselves. What should someone invest in? Well, this book talks about basic investing concepts like stocks and bonds:

- A stock means you’re buying a small part of a company.

- A bond means you’re lending money to a big institution like a government or corporation.

Stocks and bonds both have their pros and cons. Generally speaking, investing in bonds returns less income to you, but they’re safer and more stable in price. Investing in stocks provides higher income, but they’re a little more risky or volatile. (Volatile means stocks tend to go up and down in price more in the short term.)

30 years ago, when the first edition of this book was published, Joe Dominguez invested only in something called US Treasury Bonds. However, some critics say that probably wouldn’t be the best path today because bonds pay far less money than they did 30 years ago.

So, what should we do?

Well, most of the top-rated personal finance writers recommend focusing on stock index funds, mixed with some bonds for greater stability. If you’re starting to feel a little bit lost here, then I don’t blame you! Investing can feel complicated and intimidating to a beginner! But to learn more details I recommend you take a look at our summary of Millionaire Teacher by Andrew Hallam. It’s the best book I’ve read (so far) that explains how to invest for financial freedom in a simple way.

To achieve financial freedom, your income from investments must become higher than your expenses. 30 years ago, the author retired by investing in US bonds, but today they aren’t as good so you may need to look at stock index funds.

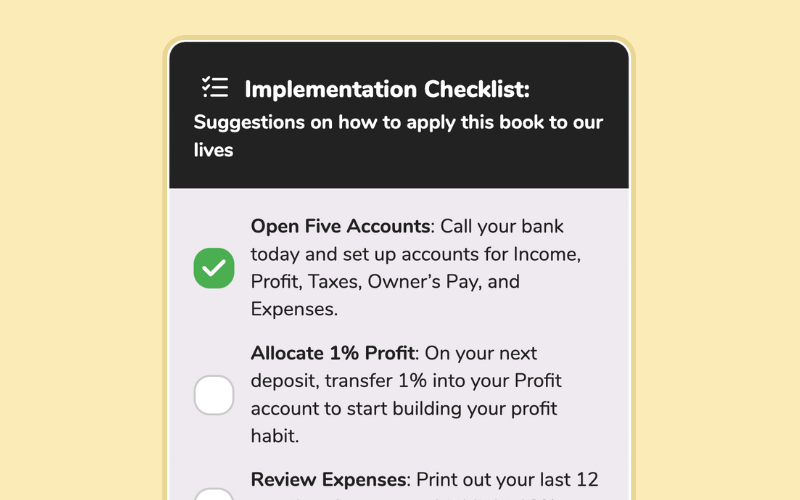

- Keep track of a daily behavior for 2 weeks. If you need to save money, keep track of your daily expenses like this book recommends. If you need to be more productive, keep track of work hours. If you need to lose weight, keep track of each meal. Remember: no shame, no blame. See how the increased self awareness affects your behavior.

- Next time you’re about to make a big purchase, translate the money into life energy. How many hours would you need to work to pay for that purchase? Will it bring you enough fulfillment to justify that cost? Does this exercise change your attitude towards the spending?

- Remove 3 pieces of clutter from your life. What possessions have you not used in months or years? Can you sell them on eBay or online classifieds? Or maybe donate them to a secondhand shop? See how you feel afterwards.

Update 01/24: Better subtitles formatting and meta fields for ‘financial literacy’ list

Community Notes