How can we go from having little savings to enjoying financial freedom?

Maybe the answer can be found in The Richest Man in Babylon. You’ve probably heard the name before, even though it was originally published in 1926! It continues to be one of the most recommended books on money, right alongside classics like “Think and Grow Rich” and “Rich Dad, Poor Dad.”

This book teaches essential lessons in finance, through a series of short stories. The stories are all fictional (not true) and set in ancient Babylon. It’s a lot less boring than your average finance book because the lessons are cleverly hidden inside the stories, as the characters make mistakes with their money and learn from their experiences. In this way, it’s similar to The Alchemist, which teaches self-help concepts within a fictional story.

About the Author

George S. Clason (Wikipedia) was a soldier, businessman and writer. He is best known for writing “The Richest Man in Babylon.” It was originally published as a series of pamphlets commissioned by banks and insurance companies, then later put together into a book. He also founded two publishing companies, one of which published the first road map of the US and Canada. He retired to Napa, California.

🏦 1. Pay Yourself First: Start by saving 10% of your earnings for your future self, before paying anyone else

Imagine an ancient city in the middle of the desert, surrounded by incredibly large walls that were as tall as a 15-storey apartment building! This city really existed from about 2,000 to 8,000 years ago and it was called Babylon. The people living in ancient Babylon were surprisingly sophisticated, knowing of writing, astronomy and engineering, and enjoying fine jewels, art and culture.

The first story in the book starts with a man named Bansir, a chariot builder with no money. He’s unhappy because for decades, he has been working hard but has nothing to show for it. Bansir is talking with his friend Kobbi, a musician who is also broke.

They decide to go for help to Arkad, who is now known as “the richest man in Babylon” but was also their old childhood friend. At Arkad’s home, the rich man begins telling the story of how he became wealthy. He grew up in a regular middle-class home, then found a job working as a scribe, writing things down on clay tablets. One day, a rich money lender named Algamish needed a job done by a scribe, so Arkad said he would do the job in exchange for learning the money lender’s secret to becoming wealthy. The money lender agreed.

So the first secret to wealth Arkad learned is: “A part of all I earn is mine to keep.” And this made all the difference in his life. But what does that mean, exactly? In practical terms: Save 1/10 of each paycheck for yourself, before you pay anyone else for taxes, rent, products, etc.

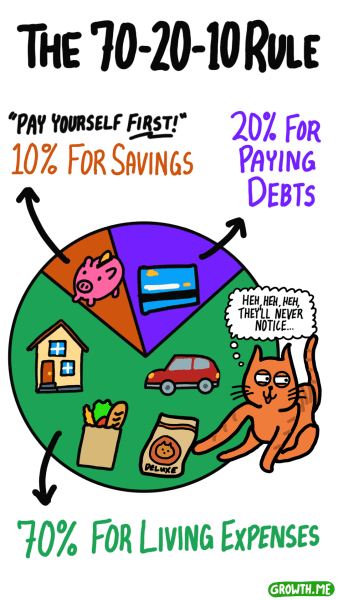

The 70/20/10 Rule says to keep 10% of your earnings for yourself—to save and invest. Use another 20% to pay off loans and credit cards. Then live off the other 70%.

At first, this advice may sound obvious. “Save your money instead of spending it all.” As a teenager would say while rolling their eyes: “like, duh.” But the fact is that most people don’t do this first essential step, even if their income is high. As a recent news headline stated, “63% of Americans are living paycheck to paycheck — including nearly half of six-figure earners.”

Why? Because society teaches us the opposite lesson. We “pay ourselves last,” first paying for what we need, then what we want, and at the end there is usually nothing left over. In fact, most of us are bombarded with messages of credit cards, payments plans, and countless loans.

Summary

✂️ 2. Lower Your Expenses: Living within our means is about drawing the line between our needs and desires

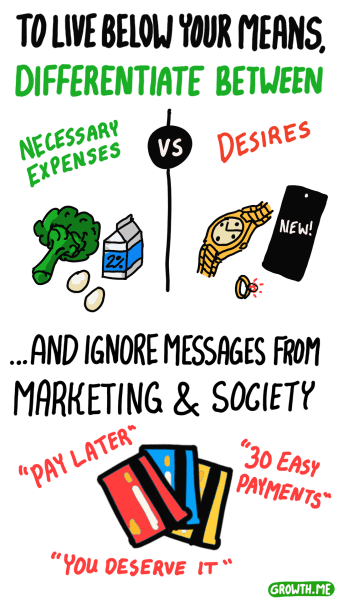

To be able to save more money, we must increase the gap between our income and our expenses. For most of us, the quickest way to do that is by reducing or eliminating expenses that are unnecessary.

We often confuse our needs with our desires, including the desire to improve our social appearance. For example, a car may be a need for many of us, but spending thousands of dollar more for one that looks really nice is about fulfilling a desire.

In the book, Arkad says we all have endless desires, they grow and multiply just like weeds in a garden, and even the richest person will never gratify all their desires. So we must learn to be satisfied with the desires that we CAN gratify after paying ourselves first.

If you read personal finance books, you’ll find most of them share this core theme of controlling expenditures:

- The Total Money Makeover, by popular personal finance guru Dave Ramsey, says “If you will live like no one else, later you can live like no one else.” The point of saving money is not to have a big number in a bank account, but so we can enjoy our lives more in the future, including buying that dream house, car, or vacation.

- The Simple Path to Wealth, a highly-rated book on investing for retirement, says “Stop thinking about what your money can buy. Start thinking about what your money can earn.” As you’ll see later, each dollar we avoid spending can go to work for us through investing, providing passive income and freedom.

- The Millionaire Next Door, a book that studied the habits of hundreds of millionaires, says “Wealth is more often the result of a lifestyle of hard work, perseverance, planning, and, most of all, self-discipline.” The authors found that the typical millionaire is not a flashy consumer that drives a red sports car, but a boring business owner that works hard, saves money, and drives an average car.

Summary

💰 3. Follow 7 Rules of Wealth: Building wealth involves saving 1/10 of your income, investing wisely, and being careful to avoid scams

In the book, Arkad is asked by the King of Babylon to give a class on how to build wealth. He gives a lecture about 7 practical steps to escape poverty, the exact title was “7 Cures For a Lean Purse”:

- “Start Thy Purse to Fattening.” This is really talking again about saving 10% of your income, repeating that first point of “paying yourself first.”

- “Control Thy Expenditures.” Here we’re back to the point of reducing expenses. Our desires will always grow, and that’s why you often hear that even most people making six figures are living paycheck to paycheck.

- “Make Thy Gold Multiply.” This is something new, and it’s really another way of saying invest your money so it will grow. In the book, the characters like Arkad do this by lending their gold to reliable local business owners, who later pay them back with interest. Today, most people invest their money through buying stocks, bonds, mutual funds, real estate, etc.

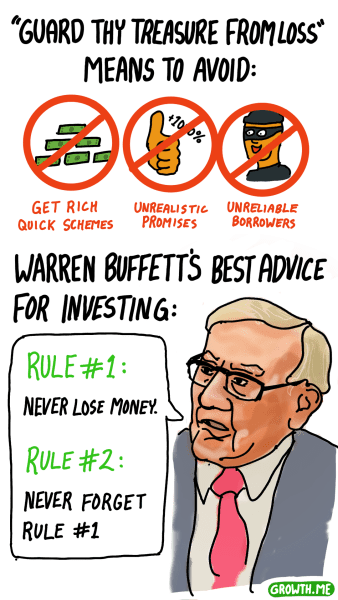

- “Guard Thy Treasures From Loss.” Here is a sobering lesson about avoiding get-rich-quick schemes and promises that sound too good to be true. Instead we must listen to people who have experience and expertise with money. Or we should be investing in a business that we are very familiar with, not something strange to us. Arkad says to his class the first rule of investing is “security for thy principle.” (Principle is investing slang for the money you begin with—make sure you don’t lose that!)

- “Make of Thy Dwelling a Profitable Investment.” He recommends buying a home, as everyone needs a place to live and it gives one’s family more space. (Some modern finance experts like Ramit Sethi would disagree with this advice, arguing that it often makes more financial sense to rent, because of “phantom costs” like maintenance, taxes, and mortgage interest.)

- “Insure a Future Income.” This one is about preparing for our retirement, so our needs can be provided for even after we’re unable to work. One part of that is having savings that are well invested so they provide a passive income stream. A second part is buying life insurance, so our loved ones would be taken care of, in case something happened to us.

- “Increase Thy Ability to Earn.” To increase our income, we must provide more value to others, and that usually requires a strong desire to level up our skills. We can do that by studying from others, practicing new skills, and being open to learning. In the book, during Arkad’s early job as a scribe, he noticed other scribes that could write tablets faster made more money. So he became diligent about improving his own productivity by learning better writing techniques from others.

(Please note The Richest Man in Babylon also has another list of lessons that are almost identical which is called “5 Laws of Gold.” Those laws are also about saving 10% of your money and investing it carefully.)

That last point reminds me of the story of Sam Walton, the founder of Walmart and one of the greatest entrepreneurs ever. In his autobiography, Sam wrote, “You can learn from everybody. I didn’t just learn from reading every retail publication I could get my hands on, I probably learned the most from studying what John Dunham was doing across the street.”

How did Sam Walton grow his business from one small-town store into the massive retail empire that Walmart is today? By always continuing to learn from others, so he could improving one small thing in his stores every day. He would even walk around competitor’s stores with a voice recorder, taking notes on all their prices and displays. But to continue improving like that we must overcome our resistance to change and our fear about looking inexperienced.

Summary

📈 4. Let Money Work For You: To become wealthy, our savings must be transformed into passive income sources through investing

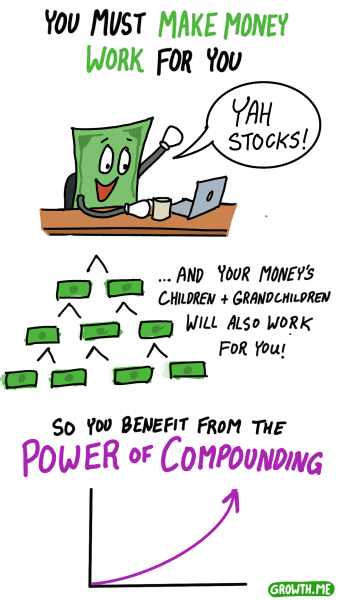

Imagine having a loyal team of workers, working 24/7 to earn you income. (Okay that would be illegal, but let’s just pretend for a moment…) And when those workers had children, they would also work for you, so that eventually you had a massive army of workers providing you income. It sounds like the lifestyle of an ancient king, but…

Well, that’s basically what investing is. When you invest, each of your dollars begins working to earn you passive income. And that new income, the “children” of your dollars, can also be put to work for you—as bad as that sentence sounds! The end result is you’ll reach financial freedom much faster.

Let’s return to Arkad’s story for a minute. Remember that Arkad was working as a scribe and he had begun paying himself first. He was starting to invest money by lending it to local business owners, who needed capital to buy supplied, and returned Arkad’s money with a lending fee called “interest.” By the way, that’s basically how all banks and financing still work today!

But there was a problem. As soon as Arkad earned some passive income, he would spend it all on parties and cakes. His mentor Algamish saw this and told him it was a big mistake to “eat the children” of his money. So Arkad learned to reinvest most of his earnings, so his wealth grew much faster.

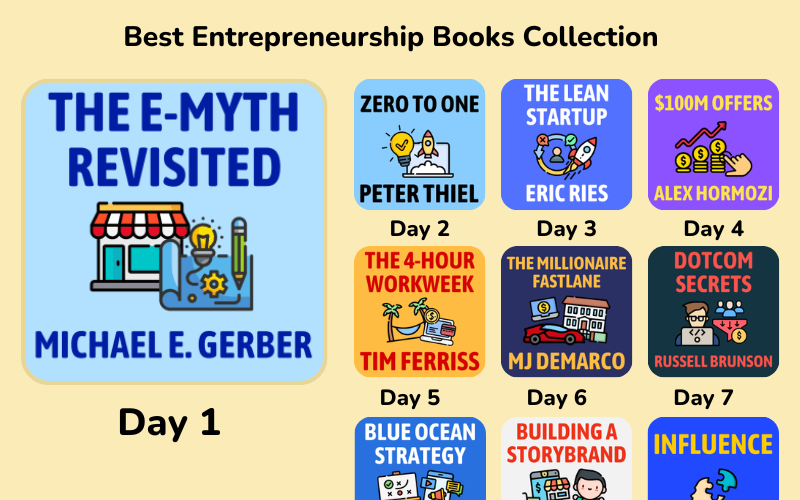

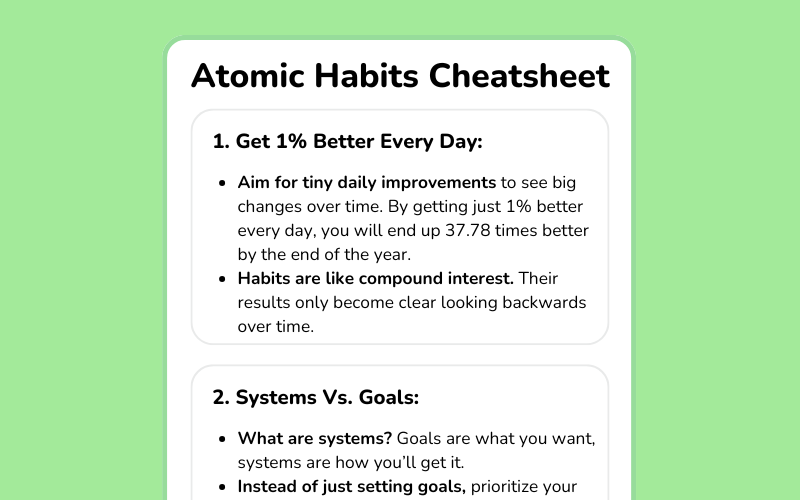

Modern investing experts talk about the same lesson when they speak of the importance of “compound interest.” Today there are countless ways that we can invest our money, but the most recommended include stock index funds and bond index funds. (These were actually invented in 1975 by investor John Bogle, that’s almost 50 years after the publication of The Richest Man in Babylon!)

When you put money into a stock index fund, you’re basically buying a small amount of EVERY stock in the market. They say this strategy is a lot less risky than trying to pick individual stocks. And compared to conventional mutual funds, the fees are much lower and average returns are higher. If you want to learn more about this, read “The Simple Path to Wealth.” Or, for a more advanced explanation, read “The Millionaire Teacher.”

Another exceptionally popular book on finance is Rich Dad Poor Dad by Robert Kiyosaki. At the core of that book is the idea of assets versus liabilities. According to Kiyosaki, “An asset puts money in my pocket. A liability takes money out of my pocket.”

Rich people buy assets, which are things that generates income like rental properties, stocks, or businesses. That’s why Kiyosaki wrote, “The rich don’t work for money. They make their money work for them.” He also argues that poor and middle class people usually spend too much money acquiring liabilities they mistakenly believe are assets, like homes and cars, stopping them from growing richer.

Read more in our summary of Rich Dad, Poor Dad by Robert Kiyosaki

Summary

🔒 5. Keep Your Gold Safe: The most important rule of investing is to avoid losing money, no matter what

Back to Arkad’s story. During his first attempts at investing, he got scammed. Arkad gave money to a brick layer who convinced him there was a great opportunity to buy jewels, but the brick layer ended up buying pieces of glass instead, losing all their money.

His mentor Algamish said they got scammed because the business was unfamiliar—of course a brick layer didn’t know anything about jewels!

Then Arkad found a smarter opportunity—giving gold so that a shield maker could buy bronze. This one paid of well. Then he found a circle of experienced businessmen, that would gather to discuss investing opportunities, and he learned a lot by following their lead. Each year his gold grew more and more.

From these experiences, Arkad learned lessons that continue to be useful for us today:

- Avoid investing in businesses or industries that are unfamiliar.

- Be suspicious of promised gains that sound too quick and easy.

- Trust the wisdom of people with more experience and expertise.

Warren Buffett, the richest investor in the world, gave this advice on investing: “Rule number one: never lose money. Rule number two: never forget rule number one.” Over the long-term, avoiding financial losses is more important than chasing wins.

So after four years of diligent effort, his mentor Algamish was retiring, and entrusted Arkad with taking care of his lands and properties. This provided a great jump in Arkad’s income and wealth, but it didn’t come overnight, only after 4 years of frugality and self-discipline.

By the way, I’m reminded that Jesus told a similar story called “The Parable of the Talents,” about a master giving three servants gold to take care of. Two of the servants invest the gold and are rewarded by their master, but one buries it into the ground out of fear and is punished. And the Bible says, “For to everyone who has will more be given, and he will have an abundance. But from the one who has not, even what he has will be taken away.” Christian teachers often interpret this to mean we must nurture our God-given talents and not let them go to waste.

Summary

🎓 6. Learn More, Earn More: Proactively boost your skills to improve your earnings and life situation

In a later chapter of the book, we meet Dabasir, a young saddle-maker also in ancient Babylon. His income was low, but he desired many fine things, and so he fell into deep debt. Desperate for money, joined a gang of robbers, but they were soon captured by the authorities and sold into slavery.

Rock bottom was an understatement for Dabasir, who was completely miserable about his unfair situation. But one day, the wife of his master began encouraging him, asking, “Do you have the soul of a free man or the soul of a slave?” With her help he escaped into the desert, barely surviving long weeks of starvation, but managed to return to his hometown. Then Dabasir finally took responsibility and repaid his debts to everyone, little by little.

What’s the lesson in this story?

- First, “where there’s a will, there’s a way.” We can complain about our current situation, but that only makes us feel worse. Or we can focus on the things within our control, and begin taking action to improve our life situation. Gradually, we can dig our way out of most problems, when we “have the soul of a free man.”

The ancient Roman Emperor Marcus Aurelius echoed the same message in his book Meditations: “You have power over your mind—not outside events. Realize this, and you will find strength.” When we understand that life is short and everyone that we know will soon be dead, then we can let go of worrying about things that don’t matter like our social reputation. - Second, invest in yourself. When we attain more knowledge and wisdom, then we also attain more skills and abilities. That means we can provide more value to other people and so our income usually increases. Obviously getting a credential from a university or a skilled trade can improve our income potential, but so can more informal methods of education…

Cal Newport is a bestselling author, computer science professor and productivity expert. When students ask him how to become successful, his advice is to “Be so good they can’t ignore you.” That means we need to be continually levelling up our skills.

For the first time in human history, the knowledge of how to learn anything is available for free online, even entire courses from Harvard and Stanford. But our greatest challenge is the limitless distraction that the internet also provides, pulling us into addictive dopamine-stimulating activities. According to Cal Newport, the key is to (daily) set aside long blocks of time, 1 or 2 hours long, when we can focus very deeply on one thing with zero distractions, so we can increase our knowledge and skills.

Summary

🍀 7. How to Get Lucky: Keep an eye out for opportunities, take action on them, and that’s when you may ‘get lucky’

When Jeff Bezos was a young man, he was constantly on the lookout for opportunity. He subscribed to many technology magazines so he would know what “the next big thing” would be before anyone else. And that is why he decided to risk everything to launch a small online bookstore called Amazon.com in 1994, that was years before most people had even heard of this new thing called “the internet.”

So, did Jeff Bezos simply get lucky, or did he contribute to his own “luck” by being on the lookout for big opportunities? Perhaps it was not random chance that he was “in the right place at the right time.” That is what I believe, anyway. The advice that Bezos would give the rest of us is “Never chase the hot thing. You have to position yourself and wait for the wave.”

This book “The Richest Man in Babylon,” makes a similar point about luck and opportunity. Most people think of luck as a box of cash falling from the sky, or someone winning the lottery… But in most our lives, luck is much more subtle.

For example, when a farmer puts in a lot of effort to plant their crops, some years they will get lucky with an incredible harvest, but other years they will get unlucky and grow much less food. Or going back to our first example, Jeff Bezos put in a lot of effort to build Amazon.com, risking his nice career, his life savings, and years of his life. After all that, he got lucky.

Therefore, to increase our chances of being lucky, we must become “men of action” and take advantage of opportunities that come our way. By doing so, we put ourselves in a position to be rewarded by luck.

Another classic success book you may have heard of is Think and Grow Rich by Napoleon Hill. It tells the fascinating story of Edwin C. Barnes, who had a lifelong dream of becoming a business partner with the legendary inventor Thomas Edison. Barnes got an entry-level job at Edison’s office, but years later he was still stuck in the same position, doing small-time work. Many people may have seen that as a failure, but Barnes hung onto his dream.

Year later, Barnes saw an opportunity when Edison invented a new voice dictation machine that nobody could sell. So Barnes offered to become the salesperson and distributor of the machine, and he eventually succeeded greatly. The book says, “That is one of the tricks of opportunity. It has a sly habit of slipping in by the back door, and often comes disguised in the form of misfortune or temporary defeat. Perhaps this is why so many fail to recognize opportunity.”

Summary

Suggestions on how to apply this book to our lives

- Write down the first step you would need to take to automatically save 10% of your income. This would usually involve setting up an automatic deposit from your main bank account to a separate account for savings or investment. It’s surprisingly easy to sign up for an automated investment service online and send automatic monthly deposits there. In the US, the most popular of these “robo advisors” is Wealthfront. The one I personally use is called Wealthsimple because I’m in Canada.

- Write down 3 expenses you can reduce or eliminate. The way I would do this is by looking over my credit and debit card statements from the last month. You can find these on your bank website or app. If you haven’t done this in a long time, then you will find some unnecessary subscriptions or expenses that you can get rid of.

- Unsubscribe from some “get rich quick” social media channels or email newsletters. To help keep our gold safe, we should be strongly hesitant about spending lots of money on whatever shiny new business opportunity is currently trending. (Whether it’s Bitcoin last year or AI this year.) Rather, we should focus our efforts in an area that we have expertise and experience in.

Community Notes