Have you ever wondered about what gives money its value? Today, even regular money like the US dollar is mostly made of digital bits flying between computers. So why is it worth anything at all?

The rise of new digital currencies like Bitcoin only makes this question more interesting. Bitcoin is decentralized, which means it is not controlled or backed up by any authority. Yet millions of people are willing to invest some of their wealth in this radical new money. Are they just speculating or gambling? Or is the blockchain technology behind Bitcoin really about to change the world?

Those were a few of the big questions in my mind when I picked up this book Digital Gold by Nathaniel Popper. As it turns out, this is not a book about Bitcoin technology or how to get rich from it. Instead, it tells the fascinating story of how Bitcoin grew and the key people who made it happen:

- From Satoshi, the mysterious unknown designer of Bitcoin,

- To the early users, often programmers passionate about freedom and digital privacy,

- To the wealthy tech investors who have now made Bitcoin a household name.

Who is Nathaniel Popper?

Nathaniel Popper (Wiki) is a New York Times reporter on technology and business. To write Digital Gold, he conducted over 300 interviews all over the world, speaking with many of the most important people in Bitcoin’s early history. Best of all, he writes in a way that makes the characters come alive, like you’re reading a great thriller book.

So right now you’re about the learn some of the key lessons from this book. You’ll see the people, events and places that caused Bitcoin’s rise. And of course, if you like this short summary, then you’ll love the full book. It’s a fun read and well worth purchasing.

🏦 1. The Evolution of Money: Cryptocurrencies shift power from banks to users

When you buy Bitcoin, what are you really getting? Essentially, you get a couple of long lines made up of numbers and letters that look random. One of these lines is your Bitcoin address and the other one is your secret key. You’re not supposed to share the key with anyone because it is like a password, allowing you to send the Bitcoin to other people’s addresses. (Although today most people use apps called wallets to manage their Bitcoin which makes the process very simple.)

Let’s ask the big question first: If Bitcoin is simply lots of people exchanging digital numbers and letters, then how can it have any value? Well, this question actually forces us to look more critically at the other types of money that we are used to, like dollar bills or gold coins. Because we can ask the same question for those: If it is just paper, then what gives a dollar bill value? And if gold is simply a shiny metal, why do people pay so much for it?

The bestselling author and historian Yuval Noah Harari says that money is a very useful common myth, and it works because we all believe in it. His research says the earliest types of money included cups of grains and large seashells. Later gold and silver became the most popular money because they were easier to store. The point is that many different objects have been used as money, not only the paper bills and coins that we are used to.

In his book Sapiens, Harari wrote, “Cowry shells and dollars have value only in our common imagination. Their worth is not inherent in the chemical structure of the shells and paper, or their colour, or their shape. In other words, money isn’t a material reality – it is a psychological construct.”

From this point of view, Bitcoin fulfills most of the qualities that any good money should have, despite being digital. Bitcoin is portable, durable and secure. And perhaps the most important part is that more and more people have faith in the value of Bitcoin. It’s a bit of a self-fulfilling prophecy.

Bitcoin even has some advantages over traditional money:

- There will never be more than 21 million Bitcoins in the world. In most countries, the central bank can simply print more money when the government wants it. But that lowers the value of all the existing money, a process known as inflation. If inflation becomes too high, then saving money becomes very difficult for people. Bitcoin does not suffer from inflation.

- The fees for using Bitcoin are very low. In our current financial systems, private banks collect hefty fees with every transaction and transfer we make. It’s like they put a toll booth on every road that we can use to spend our money. Bitcoin sidesteps all of that.

If Bitcoin is simply a long jumble of numbers and letters, then why does it have any value? Because all types of money are essentially useful common myths. Bitcoin has advantages over traditional money, like being immune to inflation from central banks and high fees from private banks.

🌐 2. The Blockchain Breakthrough: A public, decentralized database makes Bitcoin possible

Before Bitcoin, a few people had tried to create a digital money, but they were not successful. There was a passionate online community discussing the topic, particularly in an email mailing list called Cypherpunks. Their attempts at digital money included:

- Digicash by David Chaum in the 1990s

- Hashcash by Adam Back in 1997

- Bit gold by Nick Szabo in 1998

To make transactions secure, many of these currencies used cryptography, the technology first used to send secret messages during wartime. That’s why Bitcoin and is often called a ‘cryptocurrency.’ In fact, whenever you use a credit card online, your computer is using the same technology to keep your personal data safe. Complex mathematical formulas are used to scramble your data, so that even if hackers did intercept it, they still wouldn’t be able to read it. Only the computer on the other side knows the secret key to decode your data.

Yet digital money still had a big problem that nobody had been able to solve: Since digital files can be easily copied and pasted, how do you make sure people don’t spend their money twice? Traditional currencies solve this problem by relying on trusted institutions like banks to check all the transactions. But the online community dedicated to making a new digital money wanted it to be decentralized and anonymous.

Then in 2008, someone under the username Satoshi Nakamoto shared his idea and academic paper for a new digital cash called Bitcoin. (Bitcoin.org) Bitcoin borrowed many good ideas from previous digital currencies, but what made Bitcoin different from anything that had come before was a new idea called the blockchain.

The blockchain is a public database of all transactions and it is sustained by a network of computers run by the users of Bitcoin themselves. Someone would not be able to spend their Bitcoins twice because the other person’s computer would first check the public blockchain to see if the money has been used in another transaction. But why would people spend their computer power to maintain this shared database? Because Bitcoin was designed to reward people for taking part in the network. Users could earn Bitcoins while adding transactions to the blockchain, in a complicated process known as mining.

It’s fascinating to see that Satoshi came at just the right time. He put together many pieces of technology that already existed, added a couple of new ideas, and was able to create a self-sustaining financial system. In fact, timing plays a major role in every technological jump, at least according to Peter Thiel, the billionaire who cofounded PayPal with Elon Musk.

Thiel wrote, “Every moment in business happens only once. The next Bill Gates will not build an operating system. The next Larry Page or Sergey Brin won’t make a search engine. And the next Mark Zuckerberg won’t create a social network. If you are copying these guys, you aren’t learning from them.”

Digital money had been tried before, but it was not successful because users could possibly spend their money twice. Bitcoin solved this problem with a new idea called the blockchain, a public database of all transactions sustained by a network of computers run by the users themselves.

💻 3. The Early Adopters: Bitcoin first appealed to programmers and libertarians

In Digital Gold, Nathaniel Popper describes many of the people who were involved in Bitcoin early, before it was really worth anything. Generally speaking, they were either programmers, libertarians, or both.

- Computer developers were fascinated by the technology behind Bitcoin. Nobody can deny that a new kind of money that is totally digital and anonymous is like something out of a science fiction movie. It’s downright cool.

- Freedom-loving libertarians were passionate about the political philosophy that Bitcoin expresses. Some believed that a new kind of money could liberate individuals from central control and surveillance. Also, the 2009 financial crisis had made more people skeptical of traditional financial systems.

One of the first people to know about Bitcoin was Hal Finney, a software developer in California. Hal was concerned about the central authorities becoming too powerful with more access to our personal data because of the rise of the digital world. He’d been involved in previous projects related to privacy such as PGP, which was an app that allowed people to send encrypted messages to one another. One day, he was browsing a mailing list and saw one of Satoshi’s early posts. It had received only a couple lukewarm responses, but he thought the idea looked promising. So he contacted Satoshi and then helped to beta test the early Bitcoin software. Hal’s computer was the second one to join the Bitcoin network, after Satoshi’s.

By January 2009, the Bitcoin software was available for public download. After a few months, it had received several hundred downloads from curious people. The Bitcoin software itself is open source. This means after Satoshi released the software, a community of volunteer coders further developed it for many years. In fact, today only a small part of the Bitcoin software code was actually written by Satoshi. It is just another way Bitcoin expresses its guiding philosophy of decentralizing power.

The Bitcoin website forums opened in late 2009, giving the few early fans a place to gather and share ideas about how to promote Bitcoin. Some influential members included:

- Martti Malmi, Finnish software engineering student. He discovered Bitcoin while exploring political ideas related to giving individuals freedom from the state. He helped design the Bitcoin logo, wrote much of the official Bitcoin website copy, and contributed ideas to improve the software.

- Gavin Andresen, a Massachusetts programmer. He was also in favour of libertarianism. He became a lead developer on the Bitcoin software and an important public face for Bitcoin. He also set up a ‘faucet’ that gave any new users some free Bitcoins to get started.

- Laszlo Hanecz, software developer living in Florida. He was the first to use more powerful computer chips called GPUs to “mine” Bitcoins more effectively. This would foreshadow the powerful computer farms used today for Bitcoin mining. As a fun experiment, Laszlo paid another forum user 10,000 Bitcoins in exchange for having two large pizzas delivered to his home—today those would be worth over $500 million!

On July 12, 2010, Bitcoin was featured on front page of Slashdot, a very popular tech news website. This brought a huge wave of new users to the forums and thousands of downloads of the software. Over the next year, some other important events boosted the popularity of Bitcoin including both Time and Forbes magazine writing positive articles about it.

When Bitcoin was worth pennies, the early users were involved for non-financial reasons. Some were computer programmers fascinated by the technology, others were libertarians passionate about individual freedom, and many were both.

📉 4. Re-centralization: The rise and fall of Mt. Gox and other early exchanges

In mid-2010, an entrepreneur in Tokyo named Jed McCaleb created Mt. Gox, the first major bitcoin exchange. Soon, many people were going to the website to buy or sell Bitcoins using their PayPal accounts. But Mt. Gox was designed so that users would hold their Bitcoins inside the website for convenience. Unfortunately, the security measures were not great. The exchange suffered many security attacks and one time hackers were able to steal $45,000 in Bitcoin. Other Bitcoin exchanges were having their own scandals, such as one founder losing all the private keys to his customers Bitcoins and another founder disappearing altogether.

Jed soon sold Mt. Gox to Mark Karpeles, another entrepreneur living in Tokyo. The exchange was growing by a thousand users each month and it was the number one exchange of Bitcoins in the world for a couple years. But it continued to be a target for hackers and suffered losses of both Bitcoins and their customer’s personal information. Finally, in February 2004, someone found a way to hack almost all the Bitcoins from Mt. Gox’s accounts, almost 750,000 Bitcoins belonging to their customers were gone.

Some people thought the hack would be the death of Bitcoin, yet in the end it made a small impact because most recognized it was caused by the company’s carelessness not the Bitcoin technology itself. In fact, the event highlighted the wisdom of Bitcoin’s decentralized design. Satoshi had designed the money to be controlled by each user, to avoid exactly these kinds of large scale losses. Unfortunately, some centralized control had been reintroduced to the system by the exchanges for the sake of convenience.

To counter the problem, new kinds of Bitcoin wallets were being designed. Blockchain.info was a new app which helped users manage their Bitcoins, without ever letting the company itself see the users data. It was more private and anonymous, and many believed it matched the initial spirit of Bitcoin better than the large centralized exchanges. By 2013, it had attracted over 300,000 users.

Why were so many libertarians who love the idea of free markets drawn to Bitcoin? Because both systems are based on decentralization, which means there is no single point of failure. It is a bottom-up system, rather than a top-down hierarchy like a central bank controlling the money supply.

Nassim Taleb is an author who writes about economics, risk and probability. In his book The Black Swan, he explains how entrepreneurs can use the philosophy of decentralization to increase their chance of success: “The strategy for the discoverers and entrepreneurs is to rely less on top-down planning and focus on maximum tinkering and recognizing opportunities when they present themselves. So I disagree with the followers of Marx and those of Adam Smith: the reason free markets work is because they allow people to be lucky, thanks to aggressive trial and error, not by giving rewards or ‘incentives’ for skill.”

Mt. Gox was the first major Bitcoin exchange where people went to buy or sell Bitcoin. The website suffered many hacking attacks, and in 2014 they lost all their user’s Bitcoins. It was a cautionary tale of not trusting one company too much, as Bitcoin itself was designed to be highly decentralized.

🕵️ 5. The Silk Road: Story of the notorious online marketplace for drugs

In 2010, another side of the cryptocurrency world was born. Ross Ulbricht, a 26-year old surfer and science student, began working on a new type of anonymous online marketplace which was named Silk Road. It would be like Amazon, but for drugs and illegal goods. To make the website work, he used Bitcoin and an anonymous type of internet called Tor, which had been developed by US Intelligence. He developed the Silk Road website in secret, then he launched it with one listing for psychedelic mushrooms that he’d grown himself.

Over time the Silk Road grew, at first slowly, then faster and faster:

- Ross let the world know about his new marketplace with an innocent-sounding post on the Bitcoin forums, pretending to be another person who was just asking ‘if anyone had seen this.’ Soon a few people came to the website and bought mushrooms using Bitcoin.

- The word spread online through other websites like 4chan, an anonymous online message board. Some vendors signed up to Silk Road to sell their own products, including marijuana, LSD and heroin.

- In June 2011, the popular website Gawker published a long article with interviews from people who had bought drugs from Silk Road. It brought a lot of new attention to the website and thousands of new users every week.

- In early 2012, Silk Road was processing up to $35,000 in sales per day. It had become so big that it caused the price of Bitcoin itself to rise dramatically. But it was also drawing a lot of negative attention towards Bitcoin from legal authorities. Many people involved with Bitcoin didn’t want to see it connected with Silk Road because they feared the currency could be banned.

The US Department of Homeland Security created a task force named Marco Polo which aimed to infiltrate Silk Road and arrest the man behind it. Under the usernames nob and cirrus, federal agents were contacting Ross online and building trust. During that time, Ross wrote in his journal that he was becoming more worried about being caught and taking every security measure possible to avoid being tracked.

But on September 30th 2013, Ross was finally arrested after taking his laptop to work in a library near the place he was living in San Francisco. After he had logged into Silk Road as the administrator, federal agents distracted him and grabbed his open laptop. It turns out they had not found him through a technology leak, but through the Bitcoin forum where Ross had made some old posts, one of which contained his email with his real name. When the FBI took down the Silk Road, it had over one million user accounts.

In 2010, Ross Ulbricht launched Silk Road, which was like Amazon.com for drugs. Over time, it grew to have over one million users and brought negative attention to Bitcoin from the authorities. In 2013, US agents finally arrested Ross because of old posts he’d made on the Bitcoin forums.

💰 6. Crypto-Commercialization: Silicon Valley becomes a driving force in Bitcoin

As Bitcoin became more popular, more people were interested in it not for political reasons, but for the practical benefits this technology could bring. Many businesspeople were being drawn to the very low fees and freedom of international transfers. The fact Bitcoin was designed to be anonymous were less important to this new group.

Around 2012 and 2013, many new startups related to Bitcoin were launched including:

- BitInstant – A website to buy Bitcoins more quickly and easily than the Mt. Gox exchange. It was founded by a 22-year-old New Yorker named Charlie Shrem. Within a few months, they were processing over $500k/month in orders. (Aside: The early investors in BitInstant included the Winklevoss twins, who had received $65 million after suing Mark Zuckerberg for stealing their social network idea. The twins claim to own 1% of Bitcoins that exist (Investopedia) and have become billionaires because of it.)

- BitPay – A service to help businesses easily accept Bitcoin payments for their products. In fact, many of the programmers involved in Bitcoin’s early software development were later recruited to work in startups building streamlined payment systems around Bitcoin.

- Coinbase and Bitstamp – These were exchanges to buy or sell Bitcoins. Compared to Mt. Gox, they appeared to be managed in a more professional and responsible way. Coinbase in particular received over $30 million of funding from well-known tech investors in Silicon Valley. To appease authorities, these companies became serious about verifying the real identities of all their customers.

Wences Casares was a very successful serial entrepreneur from Argentina. When he first heard about Bitcoin, he had been working on his own startup called Lemon which provided people with a type of digital wallet. He could immediately see the benefits of the new technology, and would later invest millions of dollars of his own wealth into Bitcoin. But the most important role Wences played was introducing Bitcoin to many powerful and influential people, starting with his friend David Marcus, the president of PayPal. At a large private conference, he impressed many leaders in the technology and finance world with a live demonstration of the power of Bitcoin. He helped a circle of people open new Bitcoin wallets on their phones, then he transferred $250,000 from wallet to wallet to wallet almost instantly. Everyone was amazed.

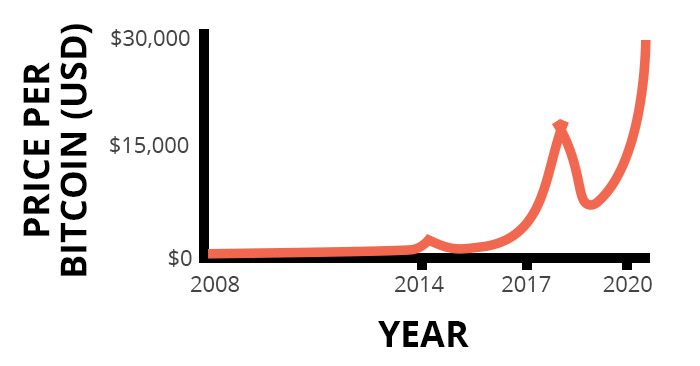

Today it’s easy to see the price of Bitcoin and feel regret for not buying it 2 or 3 years ago. However, we should remember cryptocurrencies were—and still are—very unstable. Most investment experts would not recommend buying Bitcoin as a major investment. Some would say you can invest in it only what you can easily afford to lose. (Disclaimer: this is not financial advice.)

If you want a crash course in proven investing, then one of the best books is Millionaire Teacher by Andrew Hallam. He explains the most important investing concepts in a simple way, and shares practical steps to build secure wealth. One of my favourite quotes from that book is: “The surest way to grow rich over time is to start by spending a lot less than you make.”

Read more in our summary of Millionaire Teacher by Andrew Hallam

After 3 years, more people were drawn by the practical benefits of the new technology, such as low fees and instant international transfers. Silicon Valley investors began funding many new companies which aimed to make Bitcoin easier to use for people and businesses, like BitInstant, BitPay and Coinbase.

Conclusion

As the book Digital Gold is ending, Nathaniel Popper writes there is some irony in the direction of Bitcoin. It began as a disruptive idea, aiming to decentralize power. But after a few years, much of the Bitcoin world had shifted its focus back to wealthy and powerful people like Silicon Valley investors. And while governments cannot control Bitcoin itself, they can regulate the entry and exit point to the system, meaning the places where people buy or sell Bitcoin.

To wrap things up, my favourite parts of this book were the ones that explored the idea of money itself. Most of us never stop to think about what money is and what gives it value. But when we do understand why money works, it really is a mind-blowing idea: When enough people mutually accept that something is money, then it magically transforms into a store of value… Even if it is as invisible and intangible as encrypted bits in a computer.

Community Notes