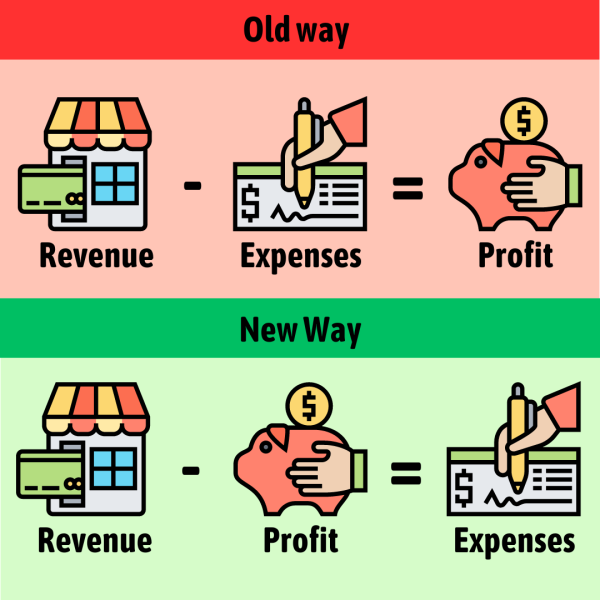

If you want to take control of your business finances to achieve consistent profitability, then “Profit First” by Mike Michalowicz is a must-read. Contrary to traditional accounting methods—which often leave profit as an afterthought—this method flips the formula to Sales – Profit = Expenses, almost forcing you to operate your business more efficiently and profitably.

This book basically applies the classic personal finance strategy of “pay yourself first” to the business world, introducing a simple yet powerful money management system that ensures profit becomes essential, not optional.

Whether you’re aiming to improve cash flow, reduce financial stress, or sustainably grow your business, this book provides an essential framework you need to know. In the following summary, we’ll cover the key takeaways from each chapter, so you can understand and start applying this powerful strategy today.

You’ll also be interested in The E-Myth Revisited, one of the most recommended books for small business owners. The E-Myth is the idea that most small businesses fail because they are started by technicians, not entrepreneurs. These are people who are great at a specific skill—like accounting, web design, or baking—but don’t know how to run a business.

The solution? Work on your business, not in it. This means creating systems, processes, and automation so the business can run smoothly without relying on you for everything. The goal is to build a business that operates independently, allowing you to step back and focus on growth.

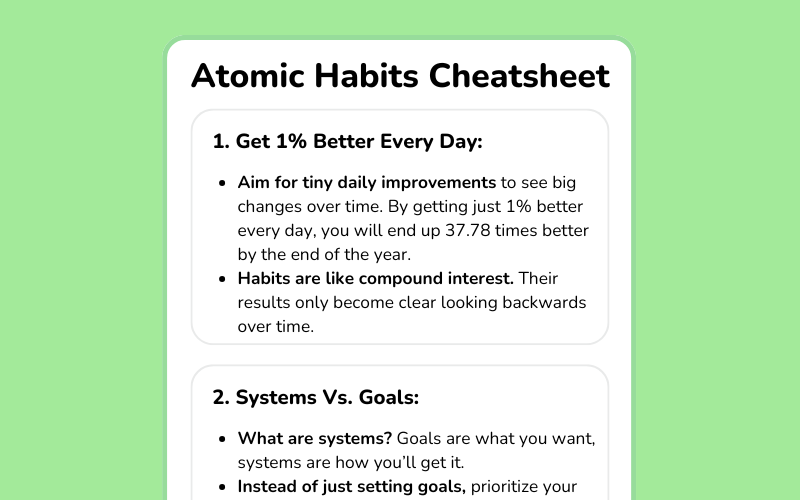

🛠️ 1. Force Innovation Through Limitation: By setting aside profit first, you limit available funds for expenses, pushing you to think creatively and find more efficient ways to run your business.

Chapter 1 Summary

- Why Most Small Business Owners Struggle with Profit: Many small business owners focus on growth, believing that more sales will eventually lead to profit. This mindset traps them in the “survival trap,” where increased revenue also means increased expenses. They work harder and expand their range of products or services, but profits remain elusive. This cycle is a major reason why 8 out of 10 businesses fail.

- The Author’s Rise and Fall: Mike Michalowicz started his first business frugally, even sleeping in his car to save on hotel costs. He sold his computer network business to a Fortune 500 company, and began receiving checks as large as $388,000. Believing he was now a business genius, he bought expensive cars and invested in several startups.

Within two years, most of these ventures failed, and he lost almost everything—including half a million dollars in personal savings. Unable to pay his bills and support his family, he realized that while he knew how to grow businesses, he didn’t know how to make them profitable. Whenever his revenue or sales grew, so did his expenses, and that ate up all the profit. - How “Profit First” is Different: Instead of relying on traditional accounting methods, which feel confusing and impractical to many small business owners, Profit First works with your existing habits, like checking your bank account daily. The system encourages setting aside profit first so you can manage your business and pay expenses with the remaining funds. This makes profit a consistent habit rather than an afterthought, helping you build a sustainable and profitable business.

Chapter 2 Summary

- The four rules of Profit First: These rules are inspired by diet strategies that help people form healthier habits. The author discovered these tips also work perfectly for managing business finances.

- Use Small Plates: In dieting, using smaller plates helps control portions and prevents overeating. In business, if you keep all your money in one big account, you’re more likely to spend all of it. By separating your income into smaller “plates” or accounts, you’ll be forced to make do with less for expenses.

When you limit how much money is available, you’ll naturally come up with smarter and more efficient ways to run your business. Cutting unnecessary costs will make your business stronger than ever before. - Consume in Order: In dieting, experts say you eat the vegetables first, before getting to dessert. Similarly in business, you need to set aside profit first, before paying bills. The order matters – focusing on profit before expenses makes sure you’re taking care of your business’s long-term health first. Profit is now the priority, not something you hope is left over.

- Remove Temptation: If junk food isn’t in the house, you’re less likely to eat it. The same trick works for your business finances: put your profit and tax money into a separate bank account that’s harder to access. When money is out of easy reach, you’re less tempted to “borrow” from it to pay bills, helping you stick to your profit goals.

- Keep a Routine: Eating at regular times every day helps keep your diet on track. Similarly, having a consistent routine for managing your business’s money will give you a clear picture of its financial health. By dividing your income into different accounts twice a month (on the 10th and 25th), you create a steady rhythm that keeps you on top of your finances.

- Use Small Plates: In dieting, using smaller plates helps control portions and prevents overeating. In business, if you keep all your money in one big account, you’re more likely to spend all of it. By separating your income into smaller “plates” or accounts, you’ll be forced to make do with less for expenses.

- Start Now: Open a new account at your bank, label it “PROFIT” and move just 1% of your income into it. Starting small is key to building confidence and forming the habit of putting profit first.

The core idea in Profit First is inspired by the classic personal finance book, The Richest Man in Babylon, which introduces the rule to “pay yourself first.” Instead of seeing saving as a sacrifice, you put aside 10% of your income for yourself first, then live on what’s left.

A similar concept is the 70/20/10 Rule: save 10% of your earnings, use 20% to pay off debts, and live on the remaining 70%.

How does setting aside profit first help your business?

Increases available funds for expenses

Forces you to think creatively and be more efficient

Allows for more luxury spending

Reduces the need for tracking finances

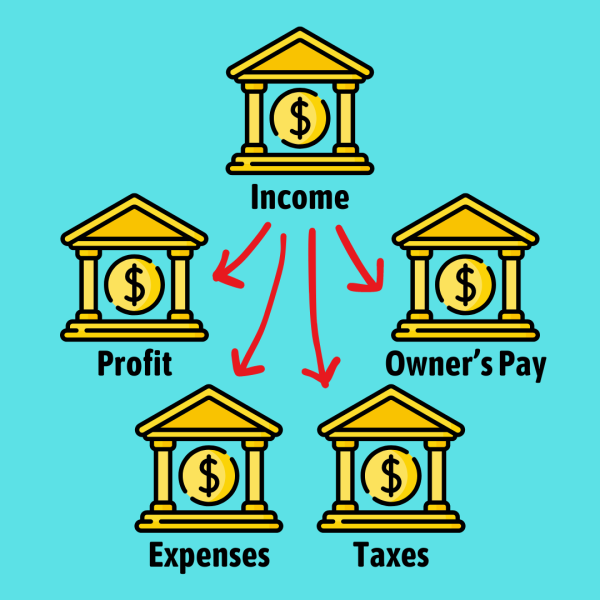

🏦 2. Set Up Five Bank Accounts: Use separate accounts for Profit, Taxes, Expenses, Income, and Owner’s Pay. This makes it easier to see exactly where your money is going and keeps your finances organized.

Chapter 3 Summary

- Set Up Your Bank Accounts: To use Profit First, you need to set up five checking accounts at your bank for: income, profit, owner’s pay, tax, and operating expenses. This way, you’ll know exactly where your money is going. Some banks might waive fees for extra accounts if you ask, or you can use a credit union that doesn’t charge fees.

Next, open two more accounts at a different bank called “Profit Hold” and “Tax Hold.” These extra accounts keep your profit and tax money out of easy reach, so you’re less likely to spend it. - Why This Works: This is like the “envelope system” that many families use to budget. They put cash into envelopes labeled “rent,” “food,” etc., and only spend what’s in each envelope. With Profit First, you’re doing the same thing but with online bank accounts.

Also, most business owners already check their bank balance every day, so this system fits right into what you’re used to doing, to help you make smarter daily decisions related to your money. It’s way easier than looking at accounting reports or spreadsheets.

The Lean Startup by Eric Ries is one of the best books for building a startup. Ries, who helped grow the early 3D social app IMVU to millions of users, introduces the idea of Vanity Metrics vs. Actionable Metrics. Vanity Metrics, like social media likes, might feel good but don’t directly impact your business’s success.

Instead, focus on Actionable Metrics that show real customer satisfaction and value. For example, an e-commerce store can track how many customers make repeat purchases, or a contractor can track how many estimates turn into actual jobs. By measuring these key metrics and running experiments to improve them, you can drive real business growth.

Which of the following is NOT one of the five bank accounts suggested in Profit First?

Income

Profit

Investments

Taxes

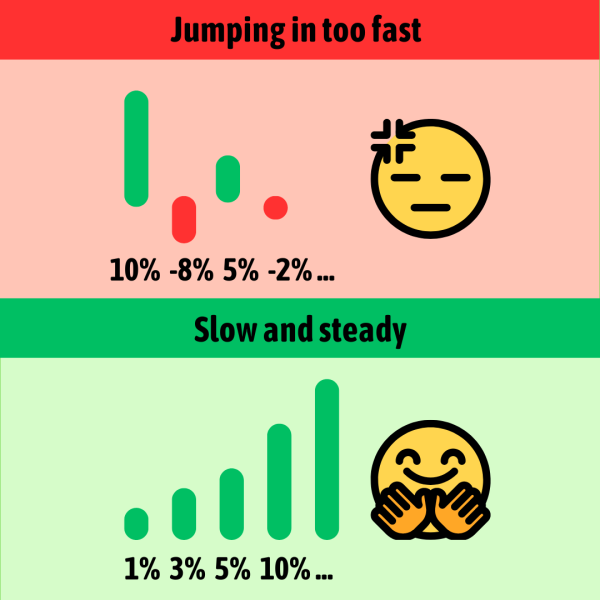

🌱 3. Start Small and Build Gradually: Begin by setting aside just 1% of your revenue as profit. Each quarter, increase this amount by an additional 1% until you reach your target.

Chapter 4 Summary

- Instant Assessment: This is a tool that helps you check the financial health of your business. Write down your current numbers for Revenue, Profit, Owner’s Pay, Tax, and Expenses. Then set target percentages for each, use the percentages to calculate your target numbers, and compare them to your current numbers to see where to adjust.

- Setting Target Percentages: New businesses will have very different target percentages than big established companies. For profit, you can begin with 5% target allocation and gradually increase it to 20% or more. Owner’s pay, on the other hand, may start as high as 50% but drop to 5% in a large company. The bigger the business, the more you’ll make from profit, not direct pay.

Chapter 5 Summary

- How to Set Target Allocation Percentages: This chapter offers more tips on choosing your percentages. You can check financial statements of public companies to see typical profit percentages, review your most profitable year from the past 3-5 years, or base it on your projected revenue for the next 12 months. The book also includes a chart with common percentages for different company sizes. Don’t overthink it—getting stuck in planning can keep you from starting.

- Increase Gradually: Start with small, easy percentages, like 1% for profit. Then, every quarter, adjust by 1-3% to move closer to your targets. Increase the percentages for profit, owner’s pay, and taxes, while reducing expenses by 1-3%. Take it slow and build up gradually for long-term success.

What is the suggested starting percentage of revenue to set aside as profit?

1%

5%

10%

20%

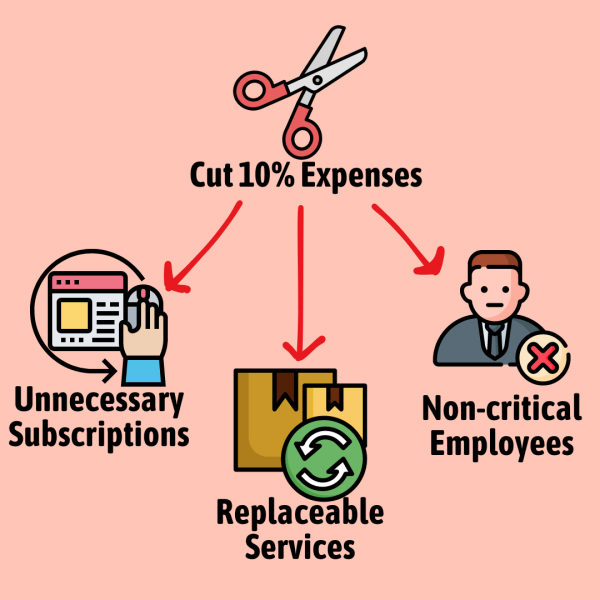

✂️ 4. Cut Unnecessary Costs: Eliminate at least 10% of your expenses. This will transform your business into being financially healthy, profitable, and enjoyable.

Chapter 6 Summary

- How to Start Profit First: On the first day, explain the Profit First system to your accountant or bookkeeper, who might resist the change because it’s not what they’re used to. Next, set up your five basic bank accounts. Beside the name of each account, write down your current percentage allocation and, in brackets, your target percentage. For example: PROFIT 1% (TARGET 15%). Distribute the money already in your bank account. Create a routine on the 10th and 25th of each month to distribute funds into the proper accounts. Every 3 months (every quarter), take half of the money out of your PROFIT HOLD account—that’s your reward for owning the business!

- Cut Expenses by 10%+: Remember, your goal is to gradually increase profits and other categories. To do that, you’ll need to lower operating expenses. While you can increase revenue, cutting expenses is something you can control right away. Review all expenses from the last year and cut out anything unnecessary, like unused subscriptions or services. You might even need to let go of employees who aren’t contributing directly to profit.

Chapter 7 Summary

- Freeze Your Debt Spending: Stop adding to your debt immediately. Commit to using 99% of your profit to pay down your existing debt. Treat it like a game – similar to Suze Orman’s advice, find joy in saving money rather than spending it. Use Dave Ramsey’s snowball method: pay off your smallest debt first, even if it’s not the highest interest. This builds emotional momentum to tackle bigger debts.

- Examine 12 Months of Past Expenses: Go through your expenses from the past year and mark each one: (P) for items that add profit, (R) for things that can be replaced, and (U) for unnecessary costs. Ask your bank to reissue your credit cards to get rid of small recurring expenses that are hard to cancel. Think creatively, like finding cheaper alternatives to high-cost systems.

What is the recommended minimum percentage of expenses you should aim to cut in the beginning?

5%

10%

15%

20%

🎯 5. Specialize for Growth: To grow effectively, focus on what your business does best. Profit-first thinking helps you pinpoint your strengths and double down on them for maximum results.

Chapter 8 Summary

- Can You Double Results with Half the Resources?: To make your business more efficient, ask yourself how you can double your results with half the time or effort. This means doing things in a completely different way, not just looking for small cost savings like most business owners do.

For example, an oil delivery company was struggling because it had two fleets of trucks – one for cans of oil for retail stores and another with large tanks for car service shops. The owner found a simple solution: “split the truck.” Each truck now carried both cans and a tank. This cut costs and helped the business grow into a $50 million company. - Focus on a Specific Type of Customer: Look at your best customers. Studies show the top 25% usually make 150% of your profit, while the bottom 25% actually cost you money. Instead of trying to do everything for everyone, take your best customer and “clone” them 100 times. The best way to be efficient is to focus on one specific type of customer. When you meet one core need really well, you get faster and better at it, like McDonald’s with its simple menu. Another example, this author says a lawn care guy who only mows lawns can make more profit than one who tries to do lawns, gutters, and roofing, which adds extra equipment costs and complications.

Traction by Gino Wickman is a must-read book for small business owners. It emphasizes having a core focus. Many businesses fail because owners get distracted by “shiny” opportunities that don’t align with their main business. Wickman explains that you succeed by becoming the best at one specific thing.

He uses the “Acres of Diamonds” story to illustrate this. A farmer sold his land and went searching for diamonds around the world. He found nothing and died poor. Meanwhile, the new owner of his farm discovered a huge diamond mine right on that same land. The lesson: most people already have what they need to succeed but lose it by getting distracted. To win, find your focus, commit to it, and put all your effort into being the best at it.

To grow effectively, what should your business focus on?

Offering a wide variety of products

Expanding to multiple markets immediately

Doubling your employees

What your business does best

🛡️ 6. Build an Emergency Fund: Create a reserve account to protect your business from unexpected costs. This adds a layer of security and stability to your financial plan.

Chapter 9 Summary

- For Advanced Needs, Add More Accounts: After 6+ months of using Profit First, you can add more accounts to fit your business’s unique needs. For example, set up a “Vault” account to cover 3+ months of emergency expenses in case sales drop, with rules for when you can use it. You can also create accounts to save for future equipment or material costs, a pass-through account for expenses paid by clients, or a sales tax account. These extra accounts help you plan for specific situations and keep your finances organized.

Chapter 10 Summary

- Apply Profit First to Personal Finance: Use the Profit First system in your personal life to gain financial freedom. In your personal bank, set up accounts for things like Savings, Paying off Debt, and Daily Expenses. Start by using 100% of your profit to pay off credit card debt using the Snowball Method (paying off the smallest debt first). Once your credit cards are paid off, cut them up, and use 50% of your profit to pay down long-term debt like your car or mortgage.

- Control Lifestyle Inflation: As your profit or income grows, it’s easy to let your lifestyle expenses grow with it. To avoid this, use the “Wedge” idea from Brian Tracy: when your income increases, only let your expenses go up by half that amount. This creates a bigger gap between what you earn and what you spend, helping you build wealth that eventually earns money on its own – and that’s real financial freedom.

Chapter 11 Summary

- Avoid Common Mistakes: The 3 biggest mistakes when using Profit First are trying to go it alone, doing too much too soon, and believing that profits must be sacrificed for growth. Find an accountability partner to stay on track. Start small with your profit percentages and build gradually—don’t rush into high percentages right away. Also, don’t fall for the idea that you need to “reinvest” all your profits for growth. Focus on making your business efficient and profitable first; then, you can scale up sales without just increasing expenses.

Why is it important to have an emergency fund for your business?

To protect against unexpected costs

To invest in new products

To pay bonuses

To expand to new locations

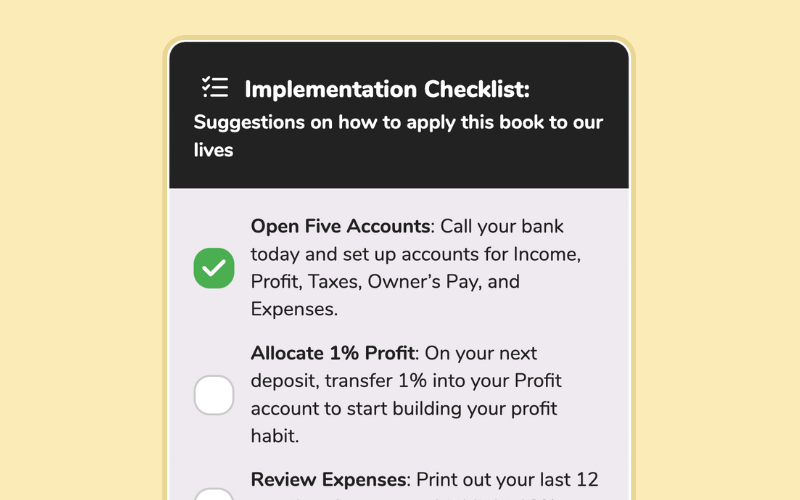

- Open Five Accounts: Call your bank today and set up accounts for Income, Profit, Taxes, Owner’s Pay, and Expenses.

- Allocate 1% Profit: On your next deposit, transfer 1% into your Profit account to start building your profit habit.

- Review Expenses: Print out your last 12 months of expenses, highlight 10% to cut, and cancel those items immediately.

- Schedule Reviews: Mark the 10th and 25th of each month on your calendar to review and allocate funds to each account.

- Create an Emergency Fund: Open a new “Emergency Fund” account and transfer a small amount (e.g., $100) into it today.

- Identify Core Customers: Write down your top 10 customers; circle those who are most profitable and plan how to find more like them.

- Track Key Metrics: Choose one metric (e.g., repeat customers) and start tracking it weekly in a simple spreadsheet.

- Freeze Debt Spending: Cut up any credit cards you use for business to prevent adding to existing debt.

- Celebrate Quarterly: Mark your calendar to review your Profit account at the end of each quarter and take out 50% as your reward.

Community Notes