This is a book on finance and investing… written for people who don’t like finance or investing!

I know that sounds funny, but the simple fact is that most people are not interested in thinking a lot about finance. Even though we all understand it is an important topic.

JL Collins wrote The Simple Path to Wealth for those people who just want to know: What do I do? Because at the end of the day, almost nobody cares about becoming a financial expert, but almost everybody wants financial security and freedom.

The good news is that we can keep our investing simple AND outperform most professionals, as you’ll see in this summary. You’re about to learn important ideas about money that we probably should have learned in school, but didn’t. Ideas such as:

- How to to use stocks to grow our wealth with less risk,

- What to do when the markets crash to avoid losing money,

- How bonds can help stabilize our financial journey.

About the author

JL Collins (official site) is now semi-retired, after spending his life working in a tremendous variety of jobs, including at an investment research firm. His popular online posts about personal finance were transformed into this book, which has now sold over 400,000 copies.

🤸 1. Get F-You Money: Achieve freedom by saving enough to cover several months of expenses

The goal is freedom, flexibility, and options. Being able to do what we want, when we want, how we want. That is the point of getting our finances in order. For JL Collins, that meant freedom from worrying about his job security and the option to spend more time with family.

F-You Money must be the first goal of our plan for financial freedom. That just means having enough money saved to pay for a few months of expenses.

If we’re living paycheck to paycheck, then we will always feel trapped and scared. Having enough money available in our bank account allows us to say… well… “F-You!” to any situation we don’t like. (The author’s colourful language for this makes it easier to remember!)

A couple tips for getting these emergency savings:

- Try saving 50% of your income. That is what JL Collins did, and recommends to others. That may sound impossible at first, but here’s a thought: Aren’t many of our ‘necessities’ in life really just ‘nice conveniences’ that people easily lived without 100 years ago?

- See the opportunity cost of purchases, that can help us save more. When we pay $100 for a cool new toy, we are not just giving up that $100. We are also giving up all the money that $100 could have earned us by being invested. This is called the “opportunity cost.” As you’ll see in a minute, with the right investment strategy our money could grow a surprising amount.

There’s another great book on personal finance called The Millionaire Next Door, written by two authors who spend 20 years studying millionaires. What they found was very surprising. Most people believe a ‘typical’ millionaire lives in a big mansion, drives a luxury car, and wears flashy clothing. But they discovered the average millionaire is usually a blue-collar small business owner that lives a regular middle class lifestyle. They are millionaires hidden right next door to me and you.

What really makes them better than the average person at accumulating wealth is not a very high income, but saving at least 15% of their income. In fact, that book says 2/3 of high-income professionals like doctors have relatively low net worth, because they fall into a trap of needing to spend more to look successful.

F-You Money means saving enough cash to pay for several months of expenses. It gives us freedom from many fears, worries, and anxieties. The author recommends saving 50% of our income by considering what we really need and the opportunity cost of each new purchase.

💳 2. Pay Off Debt Quickly: Carrying a lot of debt is the biggest obstacle to wealth

The biggest roadblock to building wealth is debt. In our culture, endless debt has become considered normal. But unless we fight back, debt will suck up a large part of our income through interest payments and excess consumption.

Pay off any debt that has an interest rate over 5% as soon as possible. (Credit cards are usually 20% or higher!) Do this before you even think about investing, because no investment can reliably make us more money than we can save by avoiding those interest payments!

Buying a house? That is often considered a “good” type of debt, but the author isn’t so sure. JL Collins suggests we buy the minimum house that we can live with, because a more expensive house will also cost more in terms of taxes, insurance, maintenance, etc. (In other places, you’ll hear financial experts talking about a mortgage as a type of “forced savings.” At retirement age, most people’s largest asset is their house.)

In the book Your Money or Your Life, they say people often consume material goods to fill needs that are actually psychological or even spiritual. That’s why it doesn’t work. That’s why most people never reach the point of feeling they have enough money or stuff. In that book, the solution is getting in touch with our real values, then keeping track of our monthly spending, so we can make sure our spending is truly aligned with what brings us satisfaction and fulfillment.

Most debt should be paid off as soon as possible, especially when the interest rate is over 5%. That will pay off more than investing. To save money, we should consider whether our consumption really fits our values, such as buying a more modest house.

📊 3. Invest in Stock Index Funds: The safer way to grow wealth is by investing in ALL the stocks in the market

Over the long term, the best way to grow our wealth is through the stock market. This is the key part of JL Collins strategy in The Simple Path to Wealth. When you look at the stock market as a whole, it has grown by 11.9% per year on average, with dividends reinvested (Investopedia) since the 1950’s and probably even since 1920’s. That means $10,000 dollars invested in 1980 would be worth almost $1 million dollars by 2020!

There are 3 main ways to invest in stocks:

- Picking individual stocks. You can buy shares in any public company, like Google or Tesla. This is risky because it’s very hard to predict the future. Nobody really knows which companies will succeed or fail. There are few investors like Warren Buffet that are successful, but we must have humility that we are simply never going to have their talent and skill.

- Actively managed mutual funds. An expert picks stocks for us. It sounds great in theory, but a study of 1,540 actively managed funds over 15 years found that 82% underperform the overall market and/or get shut down. So our odds of picking a winning fund that “beats the market” are just 18%. Not great!

- Stock index funds. We invest a little in ALL the stock in the market. This allows our money to grow at the same rate as the stock market as a whole. As we’ve seen, over decades that has been 11.9%. And that rate of growth will almost certainly beat picking individual stocks or an actively managed mutual fund.

(An important disclaimer from the author is that we are NOT guaranteed to make 11.9%, because nobody can predict the future. This number is simply used to “explore the possibilities” and the power of investing in stocks. Also, 11.9% doesn’t include taxes or inflation, so perhaps 8% is a more realistic number, one that I have seen in other personal finance books.)

JL Collins recommends the investment firm Vanguard, and especially their index fund named VTSAX. This is where he keeps most of his wealth.

Why Vanguard? They were the original pioneer of index funds and their fees continue to be virtually the lowest today. Started by John Bogle in 1976, Vanguard’s business structure was absolutely unique. You see, usually investment firms are run by owners who make profits selling their funds to customers. But with Vanguard, the people who buy their funds become the owners of the company. That means the customers are the owners, and the practical result is that Vanguard’s index funds have the lowest fees because they are operate almost at-cost.

In general, index funds have much lower fees than actively managed mutual funds. For example, the average actively managed mutual fund charges 1.25% in fees (called “expense ratio”), while Vanguard’s VTSAX costs only 0.05%. Now, 1% difference may not sound like a lot, but that is a large portion of each year’s growth, compounded year after year after year.

Beware: Some financial advisors have been more likely to promote the actively managed funds because higher fees allow for higher sales commissions. Clearly there may be a conflict of interest between the advisor and client. That is why one whole chapter in this book is titled, “Why I don’t like investment advisors.”

If you read top-rated modern personal finance books, then you’ll see the topic of index funds showing up frequently. It seems everybody today is recommending index funds, from the great Millionaire Teacher book, to Unshakeable by Tony Robbins. Even Warren Buffett has written that after his death, the wealth that his wife is left with will be invested into a low-cost index fund. As a result of all these financial educators, index funds have been shooting up in popularity, so they now make up the top 5 mutual funds in the world. (Wikipedia)

Over the past 70 years and more, the stock market has risen by 11.9% per year on average. Picking individual stocks is risky, and actively managed mutual funds underperform the market 82% of the time. Therefore JL Collins recommends index funds like Vanguard’s VTSAX, composed of EVERY stock in the market.

🏋️ 4. Build Mental Toughness: Maintain a long-term view of the economy to avoid losing money due to panic

The stock market is very volatile, which means it goes up and down dramatically, like riding a rollercoaster.

Yes, on average the US stock market goes up over time, but along the way there have been many large downturns every 10 years or so. The most recent ones being:

- the 2008 financial crisis,

- the dot-com bubble crash,

- a recession in early 90’s,

- and the early 80’s,

- and the mid 70’s,

- and so on. I think you get the point!

When the market crashed, the worst thing we could have done is panic sell. Then we would have been “locking in” our losses. If we just held on for 2-3 years until the recovery, then we would have lost nothing!

Here are some tips:

- Learn the history. If we understand that recessions are normal, then we will expect them and avoid getting too emotional. The news makes money through advertisements, so they tend to feed the panic and excitement.

- Just keep buying. The best move in previous downturns would have been to continue buying index funds. One novel way to look at it is that stocks have gone on sale for a short time. It can actually be the best time for young people to start investing.

- Don’t time the market. Many people have the idea they will wait until the market stops going down before buying, but it’s almost impossible to predict the right timing. (Just as it’s surprisingly difficult to pick winning stocks.)

One of the most popular self help books about getting wealthy is Think and Grow Rich by Napoleon Hill. It tells the story of a man named R.U Darby who went on a quest to find gold. He travelled west, bought expensive equipment, and began digging in a spot where gold had been found. Finally, after a few months with no more gold, he gave up. He sold all the equipment to a local man. That man went back to the same spot and continued digging, and he found gold just 3 feet deeper!

The moral of the story is encapsulated by this quote from the book, “One of the most common causes of failure is the habit of quitting when one is overtaken by temporary defeat.” In the same way, selling our investments during a downturn means we miss out on all the growth in wealth when the market eventually turns around.

While the stock market goes up on average, at least every 10 years there is a serious downturn, crash, or recessions. The most important thing during these times is to remain calm and not sell our investments, or we will “lock in” our losses.

⚖️ 5. Balance With Bonds: Use bond index funds to smooth out financial ups and downs as you get older

Even if you know nothing about investment, I’m sure you’ve heard people talking about “stocks and bonds.” These two go together, like ketchup and mustard, or salt and pepper. What I’m saying is that bonds are the second major type of investment in The Simple Path to Wealth.

What is a bond? When you buy a bond, you’re loaning money to a government or large company for a specific number of years. In return, they promise to pay you interest each year and then pay you back all your money at the end.

The main benefit of bonds is to stabilize our journey of growing wealthier. Bonds are far less volatile than stocks which means they don’t go up and down so much. Avoiding large downswings in our wealth becomes more important as we near retirement age. That is why older people are recommended to hold more bonds, while younger people should hold more stocks to benefit from their superior growth potential.

The basic formula for how much money to hold in stocks vs bonds is: 100 minus your age goes to stocks. So a 40-year-old could hold 60% stocks and 40% bonds. JL Collins is more aggressive, with 75% stocks, 20% bonds, and 5% cash in a bank account.

This book recommends we buy the bond index fund from Vanguard named VBTLX. It contains a wide variety of almost 8,000 US-based bonds. That allows us to avoid the risk of buying bonds from a single government or company that later cannot pay us back.

Let’s talk more about this idea of avoiding risk. One of the biggest criticisms you’ll read about JL Collins’ strategy is that it’s too simple and US-centric. He basically recommends two US-based index funds, one for stocks and one for bonds.

But what if the US stock market stops growing for 10 or 20 years? That seems improbable, but that is exactly what happened to Japan. In the 1980’s, the Japanese stock market grew at an incredible rate, but that was followed by decades of stagnation beginning in 1990. (TheFrugalDoctor) The answer given in this book is essentially: every investment has risks, but no other investment is likely to grow as much as the US stock index. And if we keep our wealth in cash, it will definitely be shrinking every year due to inflation.

We can reduce that risk by adding at least an international stock index fund and an international bond index to our investment portfolio. Many other personal finance authors recommend this strategy of greater diversification. JL Collins does not because he argues the largest US companies are already highly international and therefore not reliant on the US economy.

Target Retirement Funds (Vanguard) may be the simplest way to invest in all these funds at once. You simply pick your target year of retirement, and they automatically make sure you have the right balance of stocks and bonds for your age, both domestic and international. However, the fees are slightly higher than buying individual index funds.

Rich Dad Poor Dad by Robert Kiyosaki may be the most popular book ever written on “money.” It’s about the story of Kiyosaki learning the habits of the rich from his friend’s father, who was a successful entrepreneur in Hawaii.

The most important lesson he learned was this: poor and middle class people work for income, while rich people buy assets that make them money. We’ve talked about two of those assets already: stocks and bonds.

Other good assets mentioned in that book include:

- Real estate that generates income (not a personal home),

- Businesses that don’t need your physical presence, and

- Intellectual property that gives royalties (like music, books, patents, etc).

A bond is a loan with a specific end date, that you provide to a government or large company, in exchange for annual interest. To reduce risk, this book recommends VBTLX, a bond index fund offered by Vanguard. Target Retirement Funds offer more diversification by including international funds.

💰 6. Withdraw 4% Per Year: To keep your finances stable in retirement, don’t withdraw too much too soon

Here’s a great question: How much do you need to save for retirement? We can work backwards to find the answer.

The number to remember is 4% per year. That is how much you can withdraw from your investments during retirement, and there is a 96% chance you won’t run out of money. If you withdraw more than 4%, there is a higher chance you could run out. This ‘magic’ number was discovered in 1998 by three professors in Trinity University, and it’s been a staple of personal finance advice ever since. Their example portfolio included 50% stocks and 50% bonds.

A couple example scenarios:

- If you want to have a retirement income of $40,000 per year, then how much do you need saved? Well, $40,000 is 4% of $1 million, so that is how much you need.

- On the other hand, if you can live with $20,000 per year, then you only need $500,000. It all depends on how much you want and need. If you can live with less, then perhaps you could retire earlier.

Remaining aware and flexible can increase our financial stability. The author says he actually goes a bit higher or lower than that 4% number, based on how the stock market is doing. If the value of stocks go down, he is prepared to be more frugal with spending, to preserve his wealth and decrease the odds of running out of money.

During retirement, we can withdraw 4% of our investments per year to avoid running out of money 96% of the time. For example, if you want $40,000 annual income in retirement, you’ll need to save $1 million over your career.

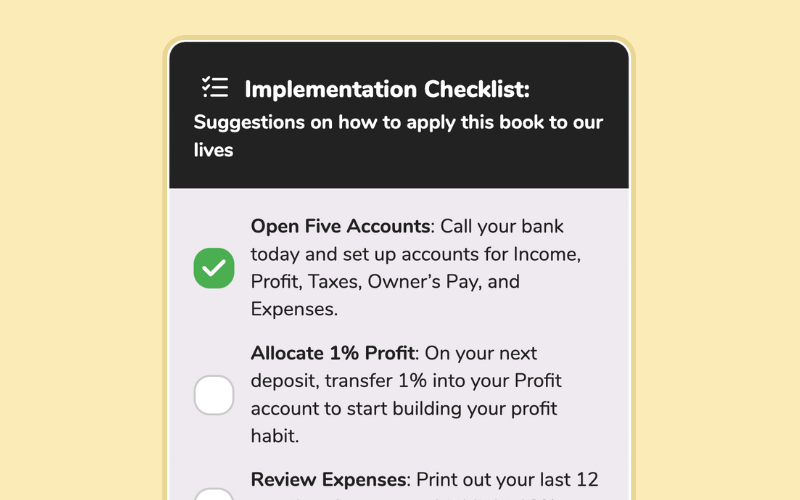

- Write down 3 expenses you could reduce or eliminate next month. The easiest way to do this would be looking at your credit card and bank statements. Often we forget how much money we are spending in certain areas. This exercise is the first step to freeing up income to get our of debt, build an emergency fund, or increase investing.

- Calculate the opportunity cost of a large purchase. This means seeing not just how much something costs us, but also what it costs in terms of potential future growth. For example, $100 put into a stock index fund that returns 8% per year could be worth over $735 in 25 years. That impressive future payoff can make us think twice about what we are spending money on today.

- Open an investment account and invest $50. Sometimes the first step can be the most important to take. If you don’t yet have a place to invest your savings, it may surprise you how easy it is to begin. In 30 minutes, you could open an account at your bank or at Vanguard, which this book recommends. Online services are becoming increasingly popular like Wealthfront in the US or WealthSimple in Canada, which I use personally.

Community Notes