💰 1. The Truth About Real Millionaires: What if everything you’ve been told about millionaires is wrong? Here’s what a day in their life actually looks like…

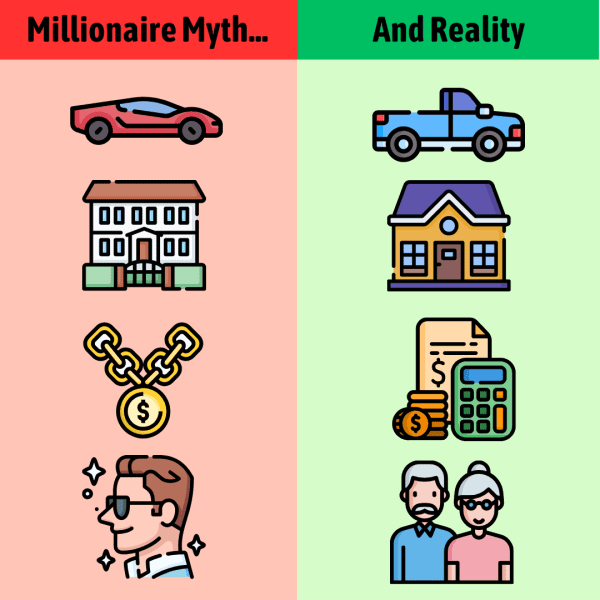

When you hear the word “millionaire,” what comes to mind?

A large mansion? A red Ferrari? Gold watches and private jets?

Yeah… that’s what most people think, but that image is way off. At least, according to the 20 years of research and nationwide surveys that led to The Millionaire Next Door. This book sold millions of copies and basically reshaped the personal finance world. Both authors have PhDs and one of them was a marketing professor.

So, what’s the reality?

Most millionaires live “undercover lives”

Most real millionaires live quietly, under the radar. No flash, no flex—just smart financial choices.

They’re not celebrities or tech CEOs. They’re everyday people—plumbers, teachers, small business owners—who spend less than they earn, avoid debt, invest regularly, and live way below their means.

Instead of spending their money chasing status to appear wealthy, millionaires save their money to build real wealth.

What does the “average” millionaire look like?

Picture this: Joe is 57. He owns a plumbing business and works 50 hours a week. He’s been married for 35 years, has 3 kids, and lives in a modest 3-bedroom house. He drives a black Ford F-150. His wife drives a used Toyota Corolla.

Sounds boring, right? But Joe’s a millionaire. And he’s not alone.

Here’s what the data shows about the average millionaire:

- Most are older, married men. Being older gave them time to build wealth.

- Around 2/3 are self-employed (often in blue-collar work).

- 80% didn’t inherit their wealth—they built it from scratch.

How? Not by earning millions—but by managing what they earned wisely.

That’s the real secret: it’s not about income—it’s about behavior.

- Most millionaires live modest, low-key lives—not flashy ones. They build wealth by spending less, avoiding debt, and investing steadily.

- The average millionaire is often self-employed, drives a regular car, and looks nothing like what you see on Instagram.

If you want to learn how wealthy investors think about money, check out The Psychology of Money by Morgan Housel. One of the book’s core lessons (and one of Warren Buffett’s go-to principles) is this:

“There is no reason to risk what you have and need for what you don’t have and don’t need.”

In other words: being rich means nothing if you blow it chasing more. Smart investors focus on staying wealthy, not just getting wealthy.

🚗 2. High Income ≠ Real Wealth: Looking rich is easy. Being rich is a whole different story. Real wealth is what you save, not what you spend.

Imagine a surgeon making $700,000 a year. You’d assume they’re set for life, right?

But if they’re spending it all on luxury cars, designer clothes, and five-star vacations, they’re not building wealth—they’re burning through it. That’s not just a hypothetical. The book shares a real-life case study of a surgeon doing exactly that.

In fact, the authors found that two-thirds of doctors accumulate relatively little wealth, when you consider they earn over $140,000 a year on average. And it’s not just doctors.

Among the top 20% of income earners, the average savings (excluding their homes) is under $60,000. They might look wealthy, but they’re one emergency away from financial stress.

The Trap of Trying to Look Successful

This is what the authors of The Millionaire Next Door call a “status trap.” High-income professionals—like lawyers, doctors, and executives—often feel pressure to look the part. They buy the big house, the luxury car, the expensive wardrobe… to match the image of their job.

But here’s the catch: the more they try to look rich, the harder it is to be rich.

For millionaires, the median income is $131,000. Interestingly, among people earning over $100K, higher education is negatively correlated with wealth building due to the pressure to maintain a high-status image with higher spending.

On the flip side, true millionaires often live modestly. Think of a blue-collar contractor driving a 10-year-old pickup truck. Nobody expects them to wear Rolexes or live in mansions—and that’s exactly why they’re quietly able to accumulate so much wealth.

The Truth About Business Owners

A lot of millionaires are self-employed. In fact, two-thirds of them own a business, often in blue-collar or “boring” industries. Many are immigrants. Many started from nothing. But they worked hard, saved aggressively, and invested wisely.

But here’s a surprising twist: most business owners don’t make much money. The average small business owner earns just $6,200 a year in profits. And many fail.

So while the wealthy are often business owners, the average business owner is far from rich. It’s just the top 5-10% that are rich. That’s why the authors say: starting a business is not a guaranteed path to wealth. It’s risky, exhausting, and success is never certain.

Ironically, 80% of millionaire entrepreneurs don’t even want their kids to take over the family business. They know how tough it is. Instead, they encourage their children to become high-income professionals like doctors or lawyers—careers that provide more stability and security.

But there’s the catch…

Pushing their kids into a high-status career—like law, medicine, or finance—can backfire. Why? Because those careers often come with peer pressure to spend big. It’s easy to fall into the status trap when everyone around you is living large.

That’s why so many children of millionaires never build as much wealth as their parents, even if they earn more. The spending habits kill their financial growth.

- A high income doesn’t automatically lead to wealth. Many professionals like doctors and lawyers fall into the “status trap” and spend too much to appear successful in line with their profession.

- While 2/3 of millionaires are business owners, but it’s not a guaranteed path to wealth—most businesses earn little or fail entirely. That’s why millionaire parents often push their kids toward stable careers.

If you want to see a great example of a “blue collar billionaire,” the best examples is Sam Walton, the founder of Walmart. He started with one small store in Arkansas and turned it into the biggest retail empire in the world.

Despite becoming the richest man on the planet, Sam drove an old pickup truck, wore basic clothes, and stayed frugal his entire life. His values helped shape Walmart’s success—and he never saw a reason to change just because he got rich.

As he said one time, “What am I supposed to haul my hunting dogs around in, a Rolls Royce?” If you’re an entrepreneur (or want to be), his story is both inspirational and brutally honest.

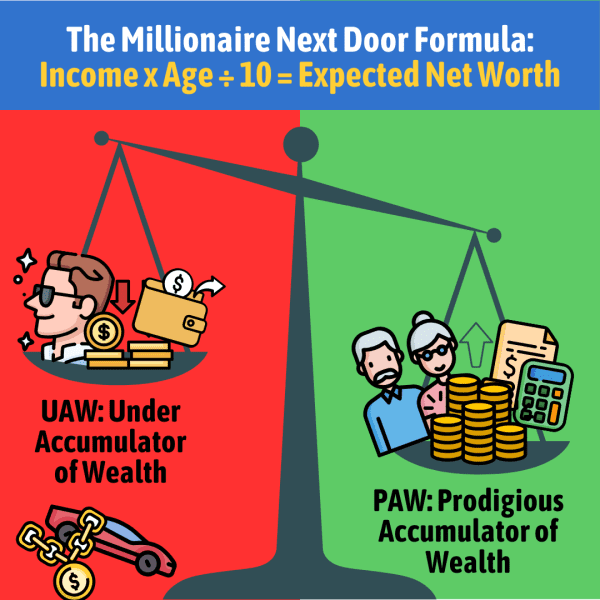

➗ 3. The Millionaire Next Door Formula: A simple way to find out what your net worth should be at your age and income

How can you find out if you’re actually building wealth—or just earning a paycheck? Here’s a simple formula for measuring wealth, from the authors of The Millionaire Next Door:

Take your age, multiply it by your annual income, then divide by 10. That number is what your net worth should be.

For example, a 40-year-old nurse making $60,000 per year should have a net worth of 40 x 60,000 / 10 = $240,000.

PAWs vs UAWs

If your net worth is:

- Double that number → you’re a PAW (Prodigious Accumulator of Wealth)

- Less than half that number → you’re a UAW (Under Accumulator of Wealth)

And yes, those are real terms used in the book.

Think of it this way: A PAW and UAW may both earn the same income, but the PAW is like a wise squirrel storing away nuts for the winter. The UAW is more like a hamster on a wheel—earning a lot but spending it just as fast.

The authors found that PAWs tend to:

- Save a big chunk of their income

- Avoid unnecessary spending

- Invest consistently

- Focus on financial independence over status

UAWs, on the other hand, often:

- Earn high incomes but spend most of it

- Try to “look rich” instead of actually being rich

- Have low net worth compared to others in their income group

Wealth building depends on your money habits

This formula is one of the biggest takeaways from The Millionaire Next Door. It shows that income alone doesn’t build wealth—your habits do.

Real wealth isn’t about showing off. It’s about making smart financial decisions, living below your means, and ignoring the pressure to impress others.

Next time you see someone driving a flashy car, remember—the real millionaire might be the person behind them in the dented, 10-year-old pickup truck.

This idea ties directly into The Simple Path to Wealth by JL Collins, a go-to book for beginner investors. One of its best quotes:

“Stop thinking about what your money can buy. Start thinking about what your money can earn.”

Instead of chasing risky investments or trying to get rich quick, the book recommends:

- Living below your means

- Saving a high percentage of your income

- Investing in low-cost index funds

- Letting compound growth do the heavy lifting over time

- Use the Millionaire Next Door Formula: age × income ÷ 10 = your expected net worth

- If you’ve saved double that, you’re a PAW (Prodigious Accumulator of Wealth). If you’re below half, you’re a UAW (Under Accumulator of Wealth).

- Wealth isn’t only about income—it’s about what you keep and grow. People become millionaires by quietly building wealth, not showing it off. Even modest earners can become wealthy with the right habits.

💵 4. Minimizing Your Tax Burden: How millionaires avoid high taxes and build wealth faster through the power of assets

Let’s talk about how the rich pay less in taxes, but without breaking any laws or doing anything shady. It all comes down to one simple strategy…

Investing in assets

Millionaires don’t just rely on their salaries—they focus on building wealth by acquiring assets. By investing in assets, they keep their taxable income low—usually under 7% of their total wealth.

Assets include things like:

- Stocks

- Bonds

- Real estate

- Businesses

These assets tend to grow in value over time, and they don’t get taxed until they’re sold. This means they can build wealth quietly, without being hit with huge tax bills every year.

Assets vs. liabilities: What’s draining your wealth?

Let’s dive deeper into the difference between assets and liabilities.

- Assets are things that grow your wealth over time—like stocks or rental properties.

- Liabilities are things that drain your wealth—like that shiny new car that loses value the second you drive it off the lot.

The wealthy buy assets and let them grow in value. The not-so-wealthy often fall into the trap of buying liabilities, thinking they’ll make them happy or impress others—but they only lose money in the long run. So, if you want to build wealth like the millionaires, the key is to invest in assets.

Millionaires typically have over 20% of their wealth in the stock market, but they are not active traders. Instead, they prefer to buy and hold investments long-term. This helps them avoid the costs and taxes of frequent buying and selling. They invest in businesses, real estate, and stocks, while those who accumulate less wealth often keep their money in cash-like assets like savings accounts and money market funds.

One of the best books that talks about the concept is Rich Dad Poor Dad by Robert Kiyosaki. The book shares lessons Kiyosaki learned from his “Rich Dad”—a wealthy entrepreneur who, despite his success, lived a modest life. The key lesson?

“The poor and middle class work for money. The rich make money work for them.”

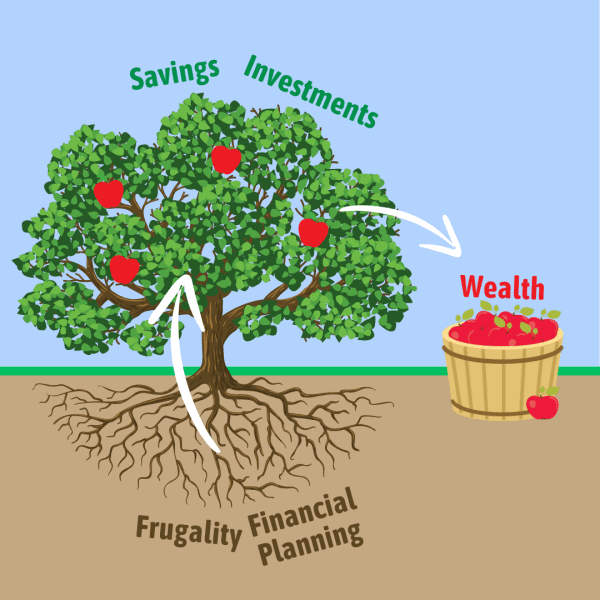

Invest 15% of Income

Millionaires save 15% of their pretax income for investing. How do they manage to save so much? Through frugality (that’s the next lesson) and financial planning.

Wealthy people spend twice as much time on financial planning—around 8.4 hours per month—compared to those who don’t build wealth. Many of them are self-employed, so they include financial planning in their regular work routine.

They also carefully choose a financial advisor, treating this decision like hiring a key employee. They check references, ask for recommendations, and interview candidates. Most people skip this step because it seems like too much work, but it’s critical for successful wealth management.

- Millionaires build wealth by investing in assets (stocks, real estate, businesses), which grow in value over time. Assets help build wealth quietly, unlike a high salary, which comes with a big tax bill every year.

- Millionaires invest at least 15% of pre-tax income. They avoid liabilities that drain money and spend twice as much time on financial planning, including choosing the right financial advisor.

🏦 5. The Foundation of Wealth: Why frugality is usually essential to creating a million-dollar net worth

Let’s talk about something most people find, well, downright boring—budgeting and financial planning.

But here’s the thing: if you want to build wealth, these concepts are your foundation.

Think of it like this: making money is your offense, but saving and budgeting? That’s your defense. And just like in any good game, you need both to win.

Saving, not spending, builds wealth

You might picture a millionaire throwing cash around like confetti. But here’s the real deal: most millionaires are actually pretty frugal. They’re not buying a new car every year or splurging on designer suits. Many millionaires also teach their children that those who look rich often aren’t—a mindset that helps avoid the trap of overspending.

For example, 37% of millionaires buy used cars, and 81% pay for them outright instead of leasing. Their average car cost? Just $24,800—which is close to the average price of a regular car at the time. They’re not driving Ferraris; they’re sticking with simple, reliable cars. Most of them shop around and negotiate prices.

And contrary to popular belief, millionaires often don’t live in fancy, high-status neighborhoods. They focus on keeping housing costs low so they have more income available for investing. The authors of The Millionaire Next Door recommend that your mortgage should be no more than twice your annual income.

The “Pay Yourself First” Habit

Two-thirds of millionaires plan their finances. They create a household budget, track their spending, and set financial goals. It’s not glamorous, and it’s not thrilling, but they know it’s the only way to get ahead. They spend over 8 hours a month just planning their finances. Sounds boring, but it works.

Another trick is the “pay yourself first” method. This means they automatically put 15-20% of their income into investments, and then live off what’s left. It’s like creating artificial scarcity—they trick themselves into being frugal, and it works.

Being frugal doesn’t mean being a miser—it just means making smart decisions every day. In a world that tells you to “treat yourself” and “live in the moment,” frugality can seem weird. But the truth is: millionaires know that wealth is built by saying no to instant gratification. They make smart, boring decisions today, so they can have financial freedom tomorrow.

One of the classic books on personal finance is The Richest Man in Babylon by George S. Clason. The book teaches simple but powerful lessons on wealth. It popularized the strategy of “paying yourself first”—saving at least 10% of your income before you pay anything else.

Here’s a gem from that book: “That what each of us calls our ‘necessary expenses’ will always grow to equal our incomes unless we protest to the contrary.”

- Millionaires build wealth by saving and budgeting—not by spending on luxuries. They focus on paying themselves first, putting aside 15-20% of their income for investments.

- Frugality and smart financial planning are the key to long-term wealth. True wealth comes from delayed gratification—making small, smart decisions every day.

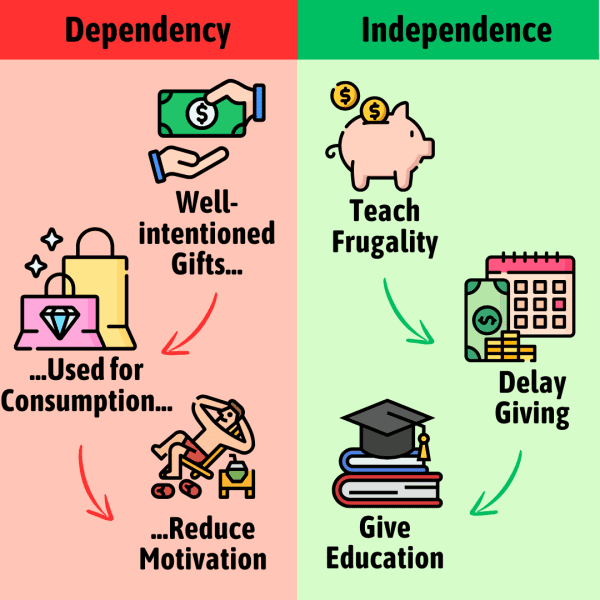

👪 6. Raising Independent Kids: How Millionaires Teach Their Children to Build (and Keep) Wealth

Most parents want to make life easier for their kids—but too much help can actually hurt. Wealthy parents often provide financial support to their adult children, thinking they’re giving them a head start. But the authors of The Millionaire Next Door found this often backfires.

Helping isn’t always helping

They call it “economic outpatient care”—they found that nearly half of millionaires give their children around $15,000 a year.

These financial gifts include:

- Helping with a home down payment

- Paying for grandkids’ private school

- Covering big expenses by providing loans that are later forgiven

Sounds generous, right? But here’s what they discovered…

The more money adult kids receive, the less wealth they tend to build on their own.

- Children who receive regular financial gifts earn 9% less

- They have 19% less net worth than those who don’t get help

- They often spend more, knowing a safety net is always there

This doesn’t just impact the kids—it also reduces the parents’ wealth. Everyone ends up with less.

Who gets the help?

Not all kids get the same support. According to the book’s research, daughters tend to receive more help than sons, especially if their income is lower. Parents may be concerned about their daughters relying on spouses, since 40% of marriages end in divorce.

In 80% of affluent families, mom is a full-time homemaker, and that structure often gets passed down. So housewives (with no income) are the most likely to receive ongoing support.

Unemployed men also tend to receive help, and 1/4 of men under 35 live with their parents, which is an indirect form of financial support.

The smarter way—teach independence

Wealthy families who build lasting wealth do things differently:

- They teach by example, living modestly, even if they’re rich

- They teach their kids to be frugal and save their own money

- They avoid talking too much about future inheritances

Many set up trusts so their kids receive money gradually—and only after becoming self-sufficient. Some even tie gift-giving to milestones like earning a degree or holding a job for a certain number of years.

The best gift? A great education.

Paying for higher education is the best gift that parents can give. Because it helps their children become independent. Smart millionaire parents invest in school, not status. That’s a big reason why kids from millionaire households are: 5x more likely to graduate from law or medical school and 6x more likely to become millionaires themselves.

- Too much financial help doesn’t actually help. It often reduces motivation and leads to overspending.

- Smart millionaires raise independent kids by teaching frugality and work ethic. They delay large gifts and invest in education instead of luxury

💼 7. Sell to the Rich: There’s a lot of money in providing services that cater to wealthy people—here are the best jobs to choose

Want to build wealth? Then doesn’t it makes sense to serve people who can pay you well?

Consider this: although only 3.5% of households are millionaires, they control over half of America’s private wealth. That’s a lot of money in a few hands!

Best jobs for cashing in

If you’re thinking about your future career or starting a business, why not target those who have the most to spend? Here are some top job recommendations:

- Estate, Tax, and Immigration Law: Wealthy people need help managing their assets and navigating complex laws.

- Medical and Dental Specialties: They value high-quality health care and are willing to pay top dollar for expert medical services.

- Professional Financial Services: Fields like accounting and financial planning are crucial for wealthy clients looking to optimize their wealth.

- Housing-Related Services: High-end home building, renovation, and property management are always in demand among the affluent.

Why this works

Wealthy people tend to be frugal with everyday expenses but don’t hesitate to invest in quality services that enhance their lives or protect their assets. They prioritize spending on:

- Financial Advice: Essential for managing and growing their wealth.

- Legal Assistance: Important for everything from business deals to personal estate planning.

- Healthcare: Premium medical services are non-negotiable for maintaining their well-being.

- To build wealth, consider careers or businesses that serve the wealthy. This can accelerate your financial success due to their willingness to pay for quality and expertise.

- Focus on areas where the affluent spend more, such as high-value services in law, healthcare, financial planning, and luxury housing.

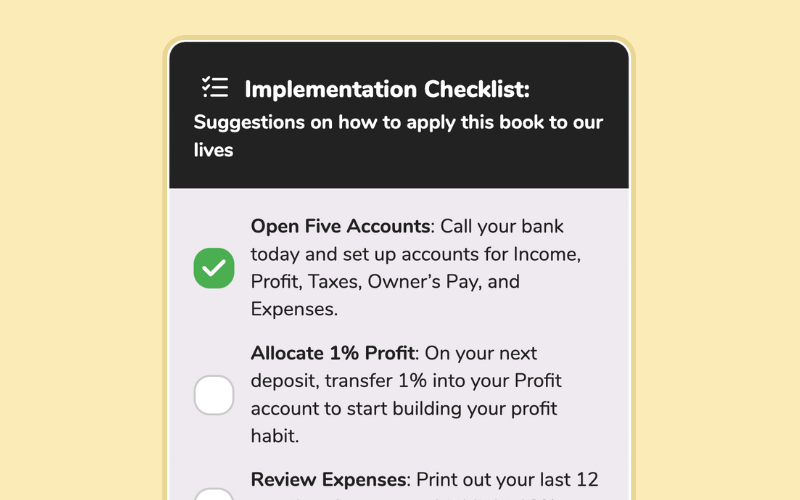

- Automate investing 15%: Set up automatic transfers from your checking account to an investing account right after each paycheck to save at least 15-20% of your income.

- Calculate your target net worth: Apply the wealth formula (age x income / 10) to find your ideal net worth. Track this yearly.

- Review Monthly Expenses: Track your spending for one month using a budget app, then identify and eliminate unnecessary expenses, such as for status-related items.

- Prioritize value over image: Choose items based on quality and needs, not brand name or prestige.

- Adopt Frugal Habits: Choose a new frugal practice each month, such as cooking at home instead of eating out, and document your savings over time.

- Learn about money: Dedicate 30 minutes daily to learning about finance and investing, whether by reading articles, watching videos, or listening to summaries like this one.

- Educate Your Children Financially: Introduce basic financial concepts to your kids through activities like saving in a piggy bank or managing a small allowance.

- Consult a Tax Advisor: Schedule a meeting with a tax professional to find tax-efficient investment strategies like IRAs or HSAs.

What best describes a typical millionaire's lifestyle?

Luxurious and high-profile

Modest and low-key

Spends without a budget

High debt, high income

What's the most common way to become a millionaire?

Saving 15-20% of income

Being a talented investor

Earning a really high salary

Inheriting wealth from parents

Why do many high-income professionals struggle to accumulate wealth despite their high income?

Lack of financial knowledge

Income is unpredictable

High-status lifestyle pressure

Investing too conservatively

How do millionaires grow their wealth?

Buying assets that appreciate

Avoiding ALL expenses

Getting extra pay raises

Avoiding paying taxes

Why do smart millionaires often delay significant financial gifts to their children?

To avoid family conflicts

To save for their own retirement

To maximize tax benefits

To prevent dependency

Community Notes