Did you know that saving just $240 per month from the ages of 25 to 65 would equal 💰 $1,000,000 by retirement? (According to CNBC.) That fact should give many of us hope for a brighter financial future.

But is there a catch? Well, CNBC assume an 9% rate of return on 📈 stock investments, which is relatively aggressive. However, financial authors like Dave Ramsey argue that even a 12% return is realistic, which means you could save even less to become a millionaire—just over $100 per month.

(Keep in mind, if you’re already 35 or 45 years old, you’ll need to save considerably more each month because compound interest has ⌛ less time to work its magic.)

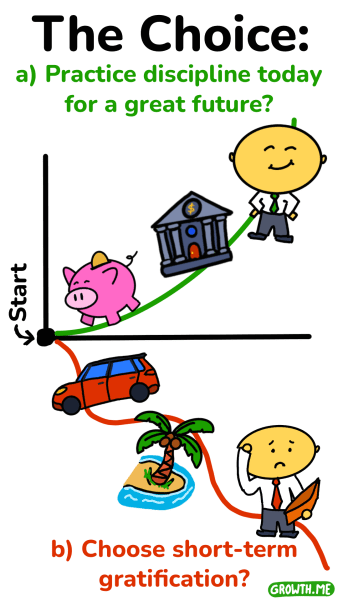

Now, is it worth it to practice discipline today, so that we can have financial security and freedom tomorrow? This challenge lies at the heart of Dave Ramsey’s book, The Total Money Makeover. (Wikipedia) It’s about living differently than the average person today, so that we can enjoy financial peace of mind that is far above-average in our future.

In this book summary, we’ll explore key lessons for achieving financial freedom, such as living below your means, paying off debt, and saving aggressively. Some of the ideas may appear simple, even common sense, but implementing them can be quite challenging, as they require being mature enough to delay gratification.

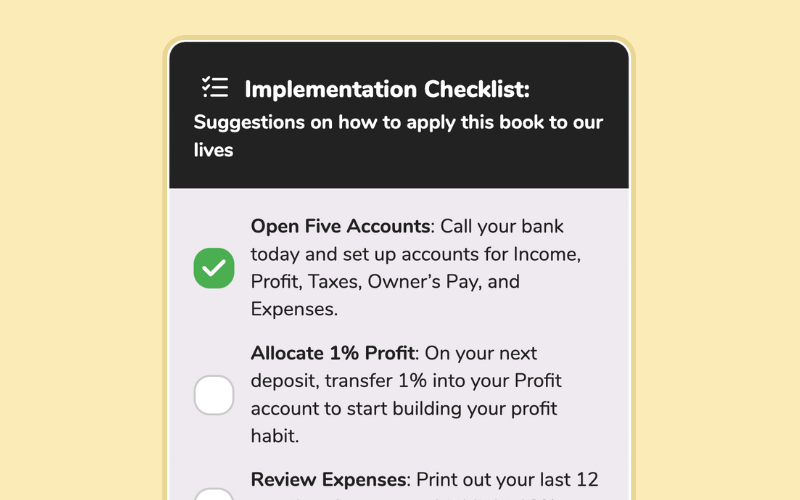

The 7 steps in Dave Ramsey’s plan are: Save $1,000 for emergencies, pay off all debt, build a 3-6 months emergency fund, save 15% of your income for retirement, fund your children’s college education, pay off your mortgage early, and then give generously.

Who is Dave Ramsey?

Dave Ramsey (official site) is a popular personal finance expert, author of 8 best-selling books, and host of a radio show with over 18 million listeners. Though he has a degree in finance and licenses in real estate, Ramsey believes his most important qualification comes from personal experience, including going through large money mistakes, financial stress, and bankruptcy.

What’s his story? Ramsey became a millionaire at just 26 through real estate. However, his success was built on a shaky foundation of debt. Unfortunately, an unfair action by the bank led to his bankruptcy, leaving him frightened with a wife and young children to take care of. But Ramsey was able to bounce back by learning to take personal responsibility and make tough sacrifices, such as trading his impressive Jaguar for a cheap older car. 🚗 Talk about a reality check!

💰 1. Build a Mini Emergency Fund First: Start your financial journey by saving $1,000, creating an initial safety net

If you lost your job tomorrow, how long would you be good for? 😰

Most people are in denial about their financial situation. They don’t realize they’re part of the 70% of individuals living paycheck to paycheck until one day, reality hits. They lose their income, the car breaks down, or they have 👶 an extra little mouth to feed. It’s often this shock that leads people to find Dave Ramsey, who will show us how to change our financial habits for the better.

We must acknowledge our need for change, or it’s easy to fall back into the trap of immediate pleasure and consumption. Then we must commit to overcoming our financial ignorance by continuously educating ourselves about money, such as by reading one book per year. This is similar to how any great marriage requires ongoing effort.

💡 Dave Ramsey’s first “Baby Step” is: Focus on saving $1,000 as quickly as possible.

Here are some key points to get us started:

- Focused action 🎯 helps us get small wins that keep us motivated. Avoid spreading your financial efforts too thin by making small payments here and there. Instead, focus only on building this emergency fund within a month, even if it means working extra hours or taking on a side job.

- A starter emergency fund keeps us from falling in debt for small problems. If something goes wrong in our lives—and it will 😓—then we want to avoid going into debt, because that will cause us to lose motivation to continue the rest of the plan.

- Keep the money safe but slightly difficult to access, like storing behind the glass of a picture frame. 🖼️ (So that we won’t be tempted to “borrow” a few bills for pizza night!)

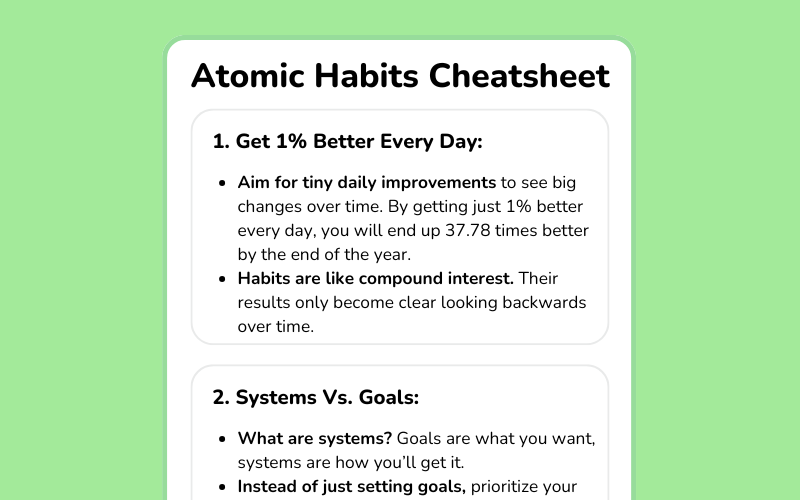

Achieving financial freedom requires 🦌 “gazelle intensity,” this is a theme repeated throughout The Total Money Makeover. Dave Ramsey was inspired with this idea after watching nature documentaries and seeing how gazelles run with full effort to survive predators. This aligns with the teachings of a classic book on money called Think and Grow Rich, which says “The starting point of all achievement is 🔥 desire. Keep this constantly in mind. Weak desire brings weak results, just as a small fire makes a small amount of heat.”

A powerful desire will drive our persistence and perseverance, even in the face of adversity and failure. A great role model for this is Thomas Edison, the great inventor of the lightbulb and countless other devices, who would often need to test thousands of materials before finding the right one. He famously said, “I have not failed. I’ve just found 10,000 ways that won’t work.” Similarly, for us failure is an opportunity to try again with a smarter strategy.

- Save $1000 starter emergency fund within a month.

- Focus on this first step and don’t dilute your financial efforts.

- Cultivate “gazelle intensity”, exert your total effort towards getting out of debt.

❄️ 2. Tackle Debt with the Snowball Method: Begin paying off your debts in order from smallest to largest, to build momentum and motivation

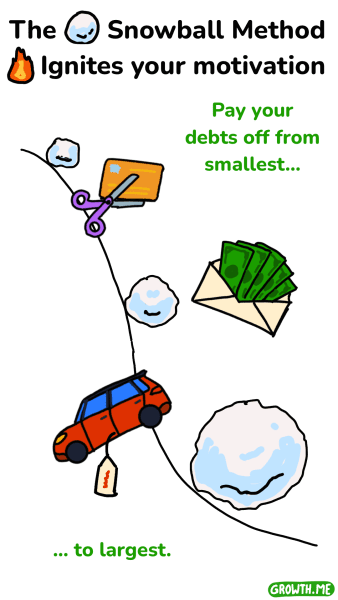

Imagine rolling a snowball from the top of a tall mountain.

As the snowball rolls down, it keeps picking up more snow, getting bigger and bigger. By the time it reaches the bottom of the hill, the snowball has become an enormous force, able to knock down anything in its way. This is a visual metaphor for how Dave Ramsey advises people to get out of debt.

The second Baby Step is to pay off all your debts from smallest to largest, regardless of interest rates. While this financial strategy may not be mathematically optimal, it’s incredibly 🧠 psychologically effective. You see, our motivation is ignited by early small wins, and maintained by gradually more difficult milestones. By the end, you’ll have great momentum to pay off your most challenging debts. This step usually takes 18-24 months to complete.

Here are some further pointers:

- Get rid of your 💳 credit cards. To get out of debt, you’ll need to stop adding to your debt! The cover of The Total Money Makeover shows Dave Ramsey smiling while holding up a large pair of scissors cutting a credit card in half. That tells you everything you need to know about his opinion of credit cards. One study shared in the book found people spend 47% more at McDonald’s when using a credit card.

- Stop saving for retirement. Yes, as a temporary measure Dave Ramsey recommends we stop spreading our financial efforts. Focus 100% on paying one debt at a time, aside from minimum payments or emergency situations. The goal is to have no payments to make in a couple years, and then you will find it easy to save a LOT of money very quickly.

- Budget using the envelope system. Write down a budget that says where every dollar will be going this month, and keep track of your spending with envelopes and 💵 cash. For example, write “Food” on one envelope and put your monthly budget for food in it. Taking cash out of this envelope registers as spending much better than using cards.

- If you get stuck, do something drastic. Sell expensive possessions, work extra shifts, have a big yard sale. Remember, it’s about living differently today so we can be free tomorrow.

To escape debt, we must overcome many of the debt myths that society has told us to believe. Myths such as debt is essential, debt is a tool, or you need to build credit. Debt adds a lot of hidden risk to our lives. If something happened, like we couldn’t work, then we’d be stuck with all that debt. And it is possible to buy a $5,000 car without a loan by saving $500 for 10 month, then later trading up. You can also get a 15-year mortgage without a FICO credit score, (Dave Ramsey) but you need good financial history and to find a company willing to do the work.

Another major obstacle to success is buying things for social acceptance, like a 🏠 house or 🚙 car that is more expensive than we can really afford. Letting go of this habit can be painful, but we must understand that most people’s lifestyles are financed by by deep debt, not genuine wealth. And that is not a situation we should hope to imitate. Ramsey often repeats the Biblical wisdom “The borrower is slave to the lender.”

There’s another great financial book called The Millionaire Next Door that gives a similar lesson. The authors studied hundreds of millionaires and discovered that the average millionaire looks just like a regular middle-class person. They’re often blue collar business owners who shop at Walmart and drive Toyotas. Surprisingly, they also found about half of America’s millionaires don’t reside in upscale neighbourhoods. This finding makes sense, as the authors explain, “It’s easier to accumulate wealth if you don’t live in a high-status neighbourhood.”

- The Snowball Method involves paying off debts from smallest to largest, excluding your mortgage.

- This approach maintains motivation through quick wins and increasingly challenging milestones.

- The envelope system uses cash-filled paper envelopes for each spending category, helping you effectively track your finances.

🛡️ 3. Complete Your Emergency Fund: Aim to save 3-6 months’ worth of expenses, to secure your financial stability

Have you ever heard of Murphy’s Law? (Wikipedia) It states that anything that can go wrong, will go wrong 😅. For example, when your car’s transmission breaks, that’s usually the same time the economy suddenly tanks, and your partner files for divorce. It’s not a scientific law but more of a funny observation that life is full of unexpected twists and turns.

By building a large emergency fund, we can better cope with life’s challenges, turning potential disasters into mere inconveniences. With enough savings, a $1,000 car repair bill becomes an annoying inconvenience rather than a devastating financial blow.

Key points to building your emergency fund:

- The third baby step 👣: Save 3-6 months worth of expenses. Aim to save between $5,000 to $25,000, depending on your personal situation. Important factors include whether you have a stable career or are an entrepreneur, whether you have a single or dual income, and whether you have a family or are single.

- Keep your emergency fund liquid. Make sure it’s easily accessible when you need the safety net. Dave Ramsey keeps his emergency fund in money market accounts.

- Practice restraint before using it. Before dipping into your emergency savings, make sure you’re faced with a true emergency. Try 😴 sleeping on the decision, discussing with your partner, or even praying to gain clarity.

- Bonus tip – Get insured. Costs related to health issues are one of the biggest causes of bankruptcy in America. Protect yourself by securing insurance for your health, home, auto, life, disability, and long-term care.

I’d like to share a related finance concept called “paying yourself first,” first written about almost 100 years ago in the classic book, The Richest Man in Babylon. This idea of “paying yourself first” challenges the common belief that saving is a form of deprivation, while spending is self-care. Instead, you can view saving as investing in your future self. 🌱

The Richest Man in Babylon also teaches the 📈 70/20/10 Rule, a helpful guideline for managing our money. It suggests 10% of your income should go to savings and investments, 20% for paying off debts, and the remaining 70% for living expenses. (Other financial experts will argue about the exact percentages, but the overall idea remains solid. For example, Dave Ramsey says to save 15%, not 10%.)

- Save 3-6 months of expenses, depending on the stability of your financial situation.

- Keep it easily accessible for emergencies in a money market fund.

- Take time to cool down before using it.

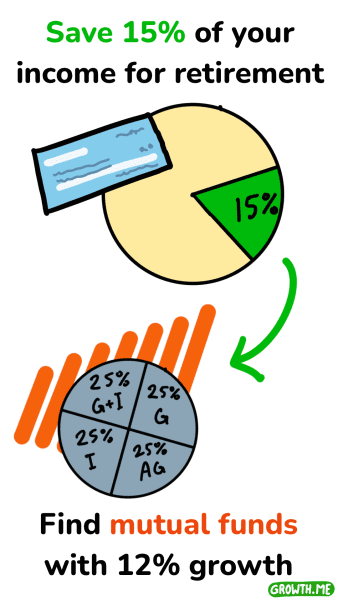

🏦 4. Set Aside 15% For Retirement: Dave Ramsey’s personal strategy is to invest 15% of income, ensuring a comfortable retirement

At this stage in the 👶 baby steps plan, you should have a solid emergency fund and be debt-free (aside from your mortgage). Now it’s time to channel the money you were using for payments into securing your future financial freedom. Let’s explore how Dave Ramsey himself invests his money!

Key points to consider:

- The fourth baby step: Save 15% of your pre-tax income for retirement. Aim to save enough so you could live off of 8% of your nest egg per year. For example, if you want $40,000 per year in retirement, then you’ll need to save $500,000. That may sound like a lot of money, but Ramsey claims that a household with an average income of $50,000 saving 15% per year for 40 years could accumulate over $7.5 million!

(Note: Most financial experts seem to recommend the “The 4% Rule,” suggesting we save enough money to live off 4% of your nest egg annually in retirement. This approach is more conservative than Ramsey’s guideline of 8%.) - Invest in Growth Stock Mutual Funds. Ramsey puts his own savings into mutual funds with a 10+ year track record of 12% annual returns. When investing in anything related to 📊 stocks, it’s important to maintain a long-term perspective, as the stock market often experiences temporary declines for a few years.

🚀 Dave Ramsey’s strategy is:- 1/4 to growth and income funds. Mutual funds designed to provide both long-term growth and short-term income from large companies, providing a stable foundation for your portfolio.

- 1/4 to growth funds. These may include an S&P 500 index fund, and generally focusing on larger companies.

- 1/4 to international funds. Funds investing in foreign companies, which helps diversify our investments and reduce risk.

- 1/4 to aggressive growth funds. Targeting emerging markets, small-cap stocks, startups, etc. Tend to have more volatility, but greater growth potential.

- Choose the right investment “container.” A variety of investment accounts are designed to help you save for retirement more quickly, often by allowing your savings to grow tax-free. Ramsey suggests first matching any employer 401(k) contributions, then fully funding a Roth IRA, then going back and fully funding the 401(k) and other investment accounts. This part of the book is the most US-centric, you may need to research local equivalent accounts in your country.

It’s time for a little 🤔 critical analysis. While Dave Ramsey and many financial advisors recommend mutual funds, other experts disagree, including many of the highest-rated modern books on investing for retirement.

📚 The Simple Path to Wealth by JL Collins is one of those books. Instead of mutual funds, he says to invest in index funds. What’s the difference? While mutual funds are managed by professionals who try to outperform the stock market, index funds are more automated and simply invest in every single stock in the market. For example, if you put your savings into an S&P 500 index fund, that means you own a tiny piece of the top 500 stocks in the US stock market.

Authors like JL Collins argue that index funds tend to outperform mutual funds for 💡 3 reasons: 1) Even professional investors are surprising bad at predicting the future, 2) They are inherently diversified into hundreds or thousands of different companies, and 3) They tend to have dramatically lower fees than actively managed mutual funds, which boosts growth. Even Warren Buffett has written that after his death, the wealth his wife is left with will be invested into a low-cost index fund.

- Save 15% of pre-tax income for retirement.

- Invest in growth stock mutual funds with a 10+ year track record of 12% returns.

- Allocate 25% each to: growth and income funds, growth funds, international funds, and aggressive growth funds.

🎓 5. Start Saving for College Early: Plan for your children’s education by setting up college funds, to avoid future student loan burdens

The fifth baby step is saving for your children’s college education.

This is undoubtedly important, but as Dave Ramsey wisely points out, let’s keep things in perspective. A college degree is often oversold as the 🏆 golden ticket to success, but it’s just as important to cultivate the right character traits, like perseverance. And remember to make your own retirement savings a priority, before you empty your pockets to stuff Junior’s piggy bank!

With that in mind, here are some basic rules to follow when saving for your children’s college education:

- Pay cash 💸 and avoid debt. Did you know the average US graduate is saddled with over $25,000 in student loan debt? Ouch! Yet many common student expenses are unnecessary and stem from the desire for a more luxurious lifestyle, like living in an off-campus apartment. By paying cash, you and your children will likely find creative ways to save money while earning that degree.

- Utilize ESA’s and 529 Plans. Educational Savings Accounts (ESAs) are like the superheroes of college savings. They allow your invested savings to grow tax-free, much like an IRA savings account. Investing just $2000 per year (or $166 per month) at a 12% mutual fund rate could leave you with a whopping $126,000 over 18 years!

- Save money any way possible. Some options to consider include going to a more affordable school, living on campus, and eating in the cafeteria. Some may even want to look into joining the military as an alternative way to fund their education.

- Snag those 📝 scholarships. Every year, millions of dollars in scholarship money goes unclaimed. Many small local scholarships are available worth $250 to $500, and every little bit helps. One of Dave Ramsey’s determined listeners applied to hundreds of scholarships and was able to secure 100% free tuition!

- Avoid student loan debt by saving money any way possible and applying for all scholarships.

- Use Educational Savings Accounts (ESAs) to speed up your savings, tax-free.

🏠 6. Pay Off Your Mortgage Early: Accelerate your journey to total financial freedom by paying off your mortgage sooner

The sixth baby step is paying off your home mortgage. If financial fitness were a sport, then paying off your mortgage early would be like winning a medal! 🏅

Once your other debts are paid off and you don’t have that many payments anymore, then you should suddenly find yourself with lots of additional money, which can be put towards paying off your home faster. For those who stick with the plan, Dave Ramsey says reaching the end of this step typically takes about 7 years! As you can see, it’s not exactly a get-rich-quick scheme!

Here are two of Ramsey’s most important pointers while buying a home:

- Pay cash for your home. This option is possible for more people than we would expect, but it takes a lot of dedication and frugality. For example, one couple with a dual income rented a very cheap apartment for $250/month, which allowed them to save a jaw-dropping $50,000 per year. In just 3 years, they bought a home for $150,000.

(Sure, these prices may be outdated due to inflation, but you can definitely see the spirit of “live like nobody else today, so later you can live like nobody else.” The result? Zero payments and zero stress.) - Stick to a 15-year fixed-rate 🏦 mortgage. (If you must have one.) Make sure your payments don’t exceed 25% of your net income. Variable rate mortgages are a bad idea, they were designed to transfer the risk of raised interest rates from banks to you, and can backfire greatly if things go wrong in your life.

- Pay off your mortgage early to finally be free of debt payments.

- When buying a home, pay cash by “living like nobody else” for a few years, or stick to a 15-year fixed-rate mortgage.

💸 7. Balance Fun, Investing, and Giving: Maintain a healthy financial life by balancing enjoyment, wise investing, and generosity

So, what happens after we become wealthy? Do we just dive into a pile of gold coins like Scrooge McDuck? Well, not exactly. According to Dave Ramsey, we can become wealthy while holding on to our psychological health by finding the right balance between having fun, investing, and giving back.

Here are some wise pointers:

- Having fun 🌴. When you can easily afford the finer things in life, there’s no harm in enjoying them. This includes a fancy watch, luxury car, or dream vacation. The problem is when people splurge on these things too soon, and fall into the debt trap.

- Investing. While your net worth is under $10 million, Ramsey recommends to keep it simple. His own wealth is invested in mutual funds and debt-free real estate. Have a team of trusted advisors for law, accounting, tax, insurance, and investment matters.

- Giving back 🎁. Ramsey says the biggest reward of wealth is being able to give to others, this is the part that never gets old. However, he firmly believes in teaching his own kids character and responsibility (such as by making them pay for their own cars), so their future inheritance won’t derail their lives.

One of the most powerful books on transforming one’s “money consciousness” is Your Money or Your Life, written by Joe Dominguez and Vicki Robin. They say people often fall into debt when we attempt to use material goods to fill inner needs that are actually psychological and spiritual. Recognizing this pattern makes it much easier to resist the pull of impulsive spending.

Dave Ramsey offers a more Christian religious take on the same idea, referring to the Bible verse that says “the love of money is the root of all evil.” That doesn’t mean that money itself is evil, but rather it can twist us when we prioritize it above higher values like faith, family, and community.

- We can use wealth to buy fun things, grow our investments, and give back to others.

- To remain psychologically healthy, money must remain a secondary priority to relationships.

- List your debts from smallest to largest. Dave Ramsey’s Snowball Method says to begin by focusing 100% of your financial efforts on paying off the smallest debt completely, which fires up our motivation to continue our “money makeover.” So how long would your smallest debt take to pay off, if you focused on it 100%?

- Determine your emergency fund target goal. This means calculating how much you spend on living expenses for 3-6 months. The exact amount you need depends on your risk tolerance and the stability of your income. Then open a money market account to place your emergency fund into.

- Calculate 15% of your pre-tax income for retirement savings. If you’re not saving this much yet, as Ramsey suggests, then identify expenses you could cut to meet that goal. For example, Ramsey often advises radio listeners to sell their expensive new car to get rid of the monthly payments, then buy a more affordable and basic used car for cash.

Update 01/24: Updated subtitles and meta fields for “financial literacy” list

Community Notes