The Little Book of Common Sense Investing by John C. Bogle explains a simple investing strategy that can grow your money while minimizing risk.

Instead of trying to pick winning stocks, Bogle says you should invest in the entire stock market through low-cost index funds.

It’s an easier and lower-risk way to grow your wealth over time, highly recommended by Warren Buffet and countless experts.

Why read it?

You need to read this book—it's a classic that anyone can learn from, whether you're new to investing or experienced.

It’s easy to understand and explains the stock market and investing clearly for beginners, with plenty of historical data to back it up. These are lessons they should teach in school but don’t, and it gave me confidence in saving for the future!

"The Psychology of Money" by Morgan Housel is about how our money and financial decisions are often determined by psychological factors such as ego, emotions, and biases.

He argues that making good financial decisions and building wealth is less about gaining financial expertise, and more about cultivating qualities like patience, humility, and long-term thinking.

Why read it?

After reading "The Psychology of Money" by Morgan Housel, I've gained incredible insights into how our emotions and biases significantly shape our financial decisions, often more than we realize.

It's not just about numbers and strategies; it's about understanding ourselves.

Housel uses engaging stories and examples that made me rethink my relationship with money.

I recommend this book because it's not just about getting rich; it's about cultivating a healthier, more self-aware approach to managing your finances and life.

It's a must-read for anyone looking to navigate the complex world of money with a clearer mind.

Fooled by Randomness is full of ideas for finance and investing that go against what most people practice.

Taleb says randomness controls our lives more than we think, but we can learn tools to protect against life's uncertainty.

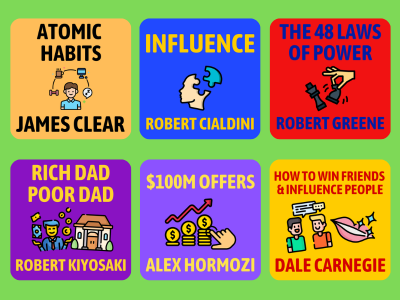

"Rich Dad Poor Dad" by Robert Kiyosaki shares financial secrets that rich people teach their kids about money, investing, and building wealth.

You'll learn how to make money work for you in smart ways, like by investing and owning businesses.

This approach is contrasted to the more traditional path of relying on a job and paycheck.

Why read it?

This book shows you why making money isn't just about getting a paycheck—it's also about finding smart ways to make your money work for you.

Why is this book so popular?

Because financial concepts are usually pretty boring, but Kiyosaki makes financial literacy fun by illustrating important ideas with stories from his childhood.